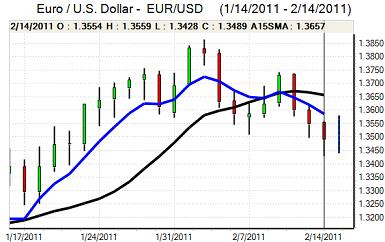

EUR/USD

The Euro faltered close to 1.3550 against the dollar on Monday and was subjected to renewed downward pressure during the European session with 3-week lows near 1.3425 as the currency was unsettled by a variety of factors.

There were further concerns over the WestLB situation with fears that no restructuring agreement for the German bank would be secured before the February 15th deadline. If there is no deal, then the bank may need to be liquidated and there would be wider fears surrounding the Euro-zone banking sector.

With Euro-zone Finance Ministers due to meet on Tuesday, there were strong indications that no short-term deal on further aid would be forthcoming at this week’s meetings with governments looking to make decisive progress at the March meetings. The economic and political barriers to a long-term solution were illustrated by ECB council member Draghi who stated that the issuance of Euro bonds made no sense without fiscal union between nations.

The latest Italian bond auctions were satisfactory, but there were further fears over an Irish debt restructuring following the February 25th elections. There were also persistent fears that Portugal would require a debt bailout and market patience will certainly be tested.

There were no significant US economic data releases on Monday and President Obama’s 2012 budget provoked little immediate reaction. There will still be unease over underlying budget and debt levels, especially with the debt ceiling an increasingly partisan issue. The Euro rallied back to the 1.3520 area in Asia on Tuesday with some further rumoured support from Asian central banks.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 83.10 against the yen on Monday, but failed to break above the 83.50 area and was generally confined to narrow ranges with the US currency still below 83.50 in Asia on Tuesday.

Although there was a slight decline in US Treasury bond yields, underlying support was still intact as markets anticipated further solid growth readings out of the US with retail sales data due on Tuesday.

As expected, the Bank of Japan left interest rates on hold in the 0.00 – 0.10% range following the latest council meeting. The bank also raised its economic assessment for the first time since May and there will be some cautious optimism that the Japanese economic performance will improve. There will still be major doubts whether this will be sufficient to improve the underlying debt fundamentals.

Sterling

Sterling was confined to narrower ranges during Monday as the UK currency was unable to break above 1.6080 against the US dollar, but did find support below 1.60. There were reports of merger-related support for Sterling and this had a greater impact given that markets were waiting for key events later this week.

The latest consumer inflation data will be released on Tuesday with expectations that the annual rate will increase to at least 4.0% compared with the 2.0% Bank of England target. There has been growing speculation that higher inflation would not necessarily support Sterling. There will be doubts whether the Bank of England will be prepared to increase interest rates and fears that any tightening would further damage the economy. The Wednesday inflation report will be extremely important in providing further evidence on the bank’s likely stance with volatility set to increase.

Sterling was blocked close to 0.84 against the Euro during Monday, but resisted losses and also consolidated above the 1.60 level against the dollar.

Swiss franc

The dollar was unable to make a further attack on resistance around 0.9770 against the franc during Monday and drifted slightly weaker to test support below 0.97. The franc advanced against the Euro, but hit resistance close to 1.3050.

The Swiss currency did gain support from renewed doubts over the Euro-zone economy and banking sector and nay bailout for Portugal would boost the franc. Any increase in focus on the European banking sector may not support the franc in the medium term give that there are important domestic vulnerabilities.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

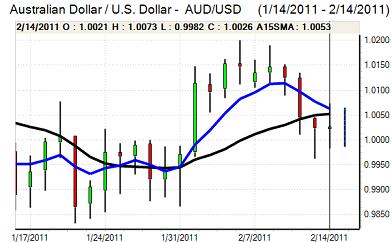

Australian dollar

From highs near 1.0070, the Australian dollar retreated to test support close to parity against the US currency on Monday before moving back to the 1.0050 area. The Reserve Bank minutes from February’s meeting were slightly more hawkish than expected, although the impact was limited given expectations that the central bank will not adjust interest rates in the short term.

The currency drew some support from lower than expected Chinese inflation data, but there were still doubts over the data’s accuracy. There will also still be fears that overall regional inflationary pressures are rising which may force more aggressive monetary action and tend to undermine the Australian dollar.