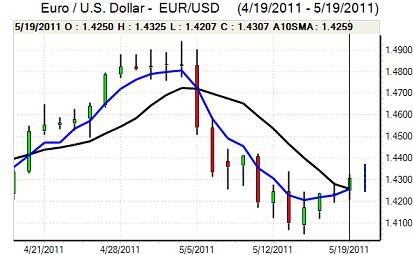

EUR/USD

The Euro found support on dips to the 1.4220 area against the dollar during Thursday and gained ground during the New York session. US jobless claims data was slightly better than expected with a decline to 409,000 in the latest week from 438,000 previously. In contrast, there was a weaker than expected reading for existing home sales with a decline to 5.05mn for April from a revised 5.09mn previously and leading indicators declined. The biggest surprise was the Philadelphia Fed index which retreated sharply to 3.9 for May from 18.5 previously and there was a particularly negative reading for new orders which will cause concern.

Overall, there will be further fears that momentum within the economy is fading. There will be significant implications for monetary policy and the Federal Reserve will find it even more difficult to move away from a very accommodative policy. Governor Dudley made generally dovish remarks in comments on Thursday and core FOMC members will remain opposed to any tightening. The US currency will still gain support for now from the anticipated end of quantitative easing in June, but any suggestion that further action will be required would be extremely destabilising for the dollar.

There were further underlying stresses within the Euro-zone as the ECB made forceful remarks surrounding the Greek situation. The central bank remains strongly opposed to any form of restructuring and also warned that Greek bonds would not be accepted as collateral.

Markets will remain in limbo until the IMF releases its interim report on the Greek economy and this will remain a negative influence on the Euro. The dollar found it more difficult to gain defensive support despite the Euro-zone difficulties which suggests that pressure for a reduction in short positions may be easing and it weakened to lows near 1.4340.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed to a high around 82.20 against the yen during Thursday and the Japanese currency was generally weaker on the crosses with the Euro advancing to a 3-week high above 117.0.

The US currency retreated following weaker than expected economic data with a retreat to the 81.50 area as US Treasury yields declined on fears over weaker economic activity.

Confidence in the Japanese economy remained very weak and there were strong expectations that the Bank of Japan would maintain a highly-expansionary monetary policy at its latest policy meeting. The central bank held interest rates in the 0.00-0.10% range at the council meeting and decided not to provided any additional stimulus at this time. There was little immediate reaction in the Japanese currency with the dollar drifting near 81.50.

Sterling

Sterling drifted weaker ahead of the economic data on Thursday with another round of rumours surrounding a weaker than expected release.

In the event, the headline retail sales data was stronger than expected with an increase of 1.1% for April compared with a consensus forecast of a 0.8% gain. There was also an encouraging CBI manufacturing survey. Nevertheless, underlying confidence in the economy remained weak with expectations that the rebound in spending would not be sustained given the underlying downward pressure on real incomes and fears over the labour market.

Sterling did advance to the 1.62 area against the dollar, but was still finding it difficult to make much headway as the Euro regained the 0.88 level.

Swiss franc

The dollar hit resistance close to 0.8880 against the franc on Thursday and retreated to lows near 0.88 as it was subjected to wider selling pressure. The Euro was able to maintain a stronger tone and pushed above the 1.26 level against the franc

The latest ZEW business sentiment index was weaker than expected with a slide to -11.5 from 8.8 previously which will increase fears that franc strength is now starting to hurt the economy. The Swiss Finance Minister also expressed concerns over the strong-franc trend.

The Swiss currency will still tend to gain underlying support from a lack of confidence in the dollar and Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support on dips to just below 1.06 against the US dollar on Thursday and pushed back to the 1.0670 area late in the US session, although there was some under-performance on the main crosses.

The Australian currency found it more difficult to gain support from an improvement in risk appetite as there were increased doubts surrounding the domestic economy. The currency has been hampered by fears that it is substantially over-valued even though attractive yields have continued to trigger strong buying support on dips.