EUR/USD

The Euro initially hit resistance close to 1.2980 against the dollar on Tuesday and retreated to re-test lows near 1.29 before advancing again. The move was sustained this time with a move to test resistance above 1.30 as the currency maintained a strong tone during the Asian session on Wednesday.

There was a further improvement in Euro sentiment on hopes for Asian buying of Euro-zone bonds in forthcoming auctions. With China and Japan both voicing support over potential purchases, there was increased confidence surrounding investor demand which would also help alleviate market stresses and lower yield spreads.

Confidence could improve further if there are successful Portuguese and Spanish auctions over the next two days, but sentiment will still be extremely fragile and conditions could certainly deteriorate rapidly again given the underlying vulnerability.

There were no major US economic data releases during Tuesday, but the latest readings for consumer confidence show that there has been a significant improvement in confidence at the beginning of 2011. Even if there is a seasonal element, there is likely to be further optimism that the US economic conditions are improving which will provide some dollar support.

There is still no evidence that the Federal Reserve is about to change policy and its aggressive monetary stance will limit the scope for dollar gains, especially if defensive currency demand fades.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 83 against the Japanese currency on Tuesday and advanced to a high near 83.50 later in the US session. With the dollar generally weaker against the Euro, this did represent significant yen weakness on the crosses, but it regained some ground in Asian trading on Wednesday. Rallies in the dollar will tend to attract exporter selling and it retreated to the 83.10 area.

There will tend to be greater optimism surrounding the global economy and this will lessen yen support on defensive grounds and there will also be some interest in carry trades funded through the Japanese currency.

There will also be speculation that following its announcement of interest in Euro-zone bonds, the Finance Ministry will encourage other institutions to increase capital flows out of Japan.

Sterling

Sterling found support on dips to the 1.55 area against the dollar on Tuesday and advanced to a high just above 1.5650 in Asian trading on Wednesday. The UK currency also maintained a firm tone against the Euro, but did hit further resistance close to 0.83.

The latest BRC shop-price inflation index reported a figure of 2.1% for December from 2.0% previously and inflation fears will remain an important short-term focus, especially as tax increases will put significant upward pressure on prices.

The inflation fears will also feature in the Bank of England MPC meeting and there is likely to be a vigorous debate over appropriate monetary policy. There will be further market speculation over a move closer to tightening at this meeting which will tend to support Sterling over the next 24 hours. The currency may then be vulnerable to renewed selling pressure if there is no action by the central bank.

The overall fundamental outlook also still looks troubling which will stem currency support and sentiment could reverse rapidly.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Swiss franc

The Euro found renewed support against the franc on Tuesday with a strong move to highs near 1.2675. With the franc under strong pressure, the dollar was also able to advance to a 2011 peak of 0.9770.

With meetings due to be held between the government and industry leaders this Friday, there will be further speculation that the government will exert strong pressure on the National Bank to weaken the currency, especially as rhetoric over the potential damage from franc strength has been strong.

Defensive demand for the franc will also weaken if there is a sustained improvement in confidence surrounding the Euro-zone economy, but sentiment could still reverse rapidly.

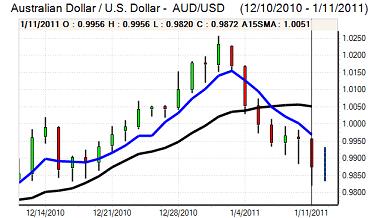

Australian dollar

The Australian dollar maintained a generally weak tone in US trading on Tuesday and retreated again in Asia on Wednesday with a test of support near 0.98 before a partial recovery.

There have been further fears over economic damage caused by intense flooding within Queensland and there has also been further speculation that the Reserve Bank will delay any monetary tightening, certainly during the first quarter, which will curb domestic currency support.

There will still be a general mood of optimism surrounding the global economy which should stem aggressive selling pressure.