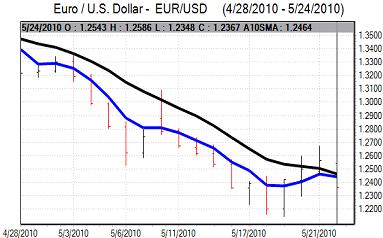

EUR/USD

Underlying confidence surrounding the Euro was still very fragile and news that the Bank of Spain had intervened to support a regional bank pushed the Euro back to just below the 1.25 area in Asian trading on Monday with further selling pressure in early European trading.

There will be unease over impact of the serious Spanish construction downturn on the banking sector and there will also certainly be wider European concerns, especially as the budget cuts will tend to undermine the growth outlook which will increase non-performing loans.

US existing home sales rose to 5.77mn for May from a revised 5.36mn the previous month with sales still being supported ahead of the expiration of tax credits. The data should help maintain some degree of confidence in the US economy which will also provide some underlying dollar support.

There was a further increase in dollar Libor rates during Monday and there is likely to be further defensive dollar demand due to fears over global credit conditions. There was also persistent speculation that global central banks were diversifying away from the Euro, especially as emerging-market currencies have been generally weaker over the past two weeks which will lessen potential Euro support.

The Euro weakened to lows just below 1.2350 during the European session before securing a tentative recovery with rallies still attracting selling interest and there was a fresh decline later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

During Asian trading on Monday, there was an increase in tensions surrounding North and South Korea which triggered a rise in risk aversion. The impact will, however, be mixed as Korean tensions also tend to undermine the yen. There was fresh speculation over a near-term move to let the Chinese yuan strengthen and this provided some limited support for the yen.

The Bank of Japan raised its assessment of the economy in its latest report. In this environment, yen selling remained limited with the dollar struggling to make headway much above the 90 level.

Yield factors remained important and some stabilisation in equity markets helped the US currency push to highs above the 90.50 level where there was a significant increase in exporter selling which made it more difficult for the US currency to make further headway.

Sterling

The UK currency also strengthened on Monday with a brief test of resistance close to 1.45 against the dollar before retreating in the European session.

The government announced spending cuts of just over GBP6bn on Monday which was in line with previous indications. The targeted approach will help sustain confidence that the government can bring the huge budget deficit under control, especially if there is an upward revision to the first-quarter GDP data.

The situation will, however, be fragile, especially as there will be expectations that much deeper spending cuts will be required in the medium term to help bring the deficit under control. There will also be fears over a lack of credit growth.

Sterling weakened to lows near 1.4350 against the dollar before rallying back to the 1.4450 area as confidence steadied.

Swiss franc

The dollar pushed to a high just above 1.16 against the Swiss franc on Monday before retreating back to the 1.1570 area later in the European session.

The Euro came under fresh selling pressure against the Swiss currency on speculation that the central bank was looking to diversify its Euro holdings into dollars. This is a particularly important factor given that the National Bank has been intervening heavily to support the Euro over the past few weeks.

The lack of confidence in the Euro will continue to underpin the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

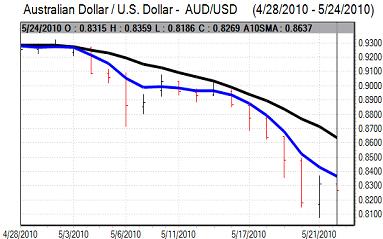

Australian dollar

The Australian dollar pushed to a high just above 0.8350 against the US dollar in Asian trading on Monday before edging lower. Overall confidence is liable to remain very fragile in the short term given underlying risk aversion and a lack of confidence in the global growth outlook.

There was some decline in selling pressure as risk conditions looked to stabilise and this allowed the Australian currency to edged above the 0.83 level later in Europe before being subjected to renewed selling pressure later in the US session.