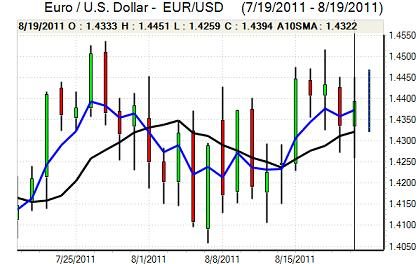

EUR/USD

The Euro found support close to the 1.4250 area against the dollar on Friday and initially consolidated close to the 1.43 area before moving sharply higher early in the US session with a test of resistance near 1.4450.

The Spanish government reported that it would take further fiscal measures to strengthen the budget which boosted optimism surrounding the structural outlook to some extent. There were also rumours that the Federal Reserve would hold an emergency meeting later in the day which undermined the dollar.

There were no meetings of the Fed, but a Euro retreat from highs was triggered more by a fresh deterioration in risk appetite as equity markets were subjected to fresh selling pressure. There will certainly be further speculation over additional policy action by the Federal Reserve. In this context, Bernanke’s speech to the Jackson Hole conference will be watched extremely closely at the end of the week, especially as the second round of quantitative easing was effectively launched at the equivalent speech last year.

There was a further increase in Libor rates on Friday and there was a further increase in tensions surrounding the European banking sector as Euro-OIS spreads increased and confidence in the financial sector remained extremely fragile.

Markets also continued to focus on the potential for Eurobonds as the intense political debate continued. There was further opposition to bonds from German Chancellor Merkel who called then exactly the wrong answer while Finance Minister Schauble stated that they would be impossible without much greater fiscal integration. The Euro retreated to the 1.4360 area in Asia on Monday as there was a further slight deterioration in risk appetite.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained under pressure on Friday as it remained blocked in the 76.60 area and there was further selling pressure in the US session. Stop-loss selling briefly pushed the currency to fresh record lows below the 76 level, but there was a recovery later in the US session with firm buying support at lower levels.

Finance Minister Noda continued to warn over the potential for decisive action to counter yen strength and markets remained on high alert over intervention. The US currency did spike high in Asia on Monday, briefly rising to above the 77 level, although this appeared to be buying by a US investment bank rather than intervention and policy credibility remained an important issue.

Risk appetite remained fragile as Asian equity markets fell for the third successive session during Monday and the yen continued to gain underlying defensive support.

Sterling

Sterling found support on dips to below 1.6450 against the dollar on Friday and again rallied sharply during the European session.

The latest government borrowing data was slightly better than expected with a net repayment of GBP2.0bn for July compared with expectations of a small deficit. For the first four months of the fiscal year, the net borrowing requirement fell to GBP40.1bn from GBP43.1bn the previous year. Tax receipts were stronger than expected which boosted sentiment to some extent, although the data does exclude the impact of financial interventions in the banking sector.

Sterling also gained some further support on defensive grounds as underlying confidence in the Euro-zone remains depressed. Sterling briefly challenged fresh 14-week highs close to 1.66 against the dollar before retreating sharply back to below 1.65.

Confidence was undermined to some extent by a warning that the banking sector could be severely weakened by proposed legislation to re-define retail banking.

Swiss franc

The dollar was unable to regain the 0.7950 level against the franc on Friday and was generally on the defensive as volatility remained high. The US currency briefly dipped to lows of 0.78 as the yen strengthened sharply, but there was strong dollar buying support on dips.

There was continuing speculation of further measures by the National Bank to weaken the Swiss currency, possibly including a tax on overseas deposits within the banking sector. There were no further measures announced over the weekend.

The franc lost some support on reports that the Gaddafi regime was on the point of collapse in Libya, but the franc regained ground as Asian equity markets were subjected to fresh selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support on dips towards 1.0320 against the US dollar on Friday and pushed sharply higher to a peak around 1.0480 as the US currency was subjected to wider selling pressure.

It was unable to sustain the gains and dipped back to test support near 1.04 on Monday. Risk appetite remained very fragile and a further downturn in regional equity markets triggered fresh selling pressure on the Australian currency. It will remain vulnerable to selling pressure if there is any further downgrade to global growth forecasts, especially as commodity prices would also be vulnerable.