EUR/USD

The Euro initially found support below 1.3050 against the dollar and attempted to rally, but it hit resistance at the old support lines just below 1.31 and retreated again to test support levels as the dollar maintained a robust tone on a shift in monetary-policy expectations.

The Euro-zone data did not have a significant impact with the flash inflation rate unchanged at 2.7% for February while there was a small increase in industrial production for the month which was below market expectations.

Underlying confidence in the Euro-zone economy remained very fragile and there were expectations that the ECB would have to maintain a very expansionary policy to bolster internal demand. There was a further decline in Italian yields to the lowest level since the fourth quarter of 2010 and, although there were reduced structural fears surrounding the economy, yield support was weaker.

There was a further increase in US Treasury yields during the day following Tuesday’s Federal Reserve meeting which helped underpin the dollar on growth and interest rate grounds. There was a further widening of yield spreads over German bunds during the day with US 10-year yields rising to over 0.3% above German yields, the widest figure since the first quarter of 2011.

There were further expectations that global central banks outside the US area were set to expand monetary policy further and this was important in providing net dollar support. The Chinese Premier’s statement that further yuan gains was now less likely had a significant impact in boosting the US currency, especially after Chinese equity markets fell sharply. The dollar maintained a firm tone in Asia on Thursday with the Euro testing support near 1.30 before correcting higher.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar held support on dips to the 83 area against the yen during Wednesday and rallied again during the day with a fresh 11-month high just above the 83.80 level.

The US currency continued to gain support on yield grounds as Treasury yields rose and this had an important impact in pushing funds into the US currency. There was also demand for the currency linked to previous call-option writing by Japanese funds.

There were further expectations that a policy shift in China to curb any further yuan appreciation would also encourage the Bank of Japan to aim for a weaker currency. There was, therefore, increased speculation that Asian economies could get dragged into a policy of competitive devaluations which would benefit the dollar. The dollar tested fresh 11-month highs above 84 before edging slightly weaker.

Sterling

Sterling advanced further ahead of the UK data releases on Wednesday with a push to near 1.5750 against the US dollar while the Euro briefly dipped to below the 0.83 level for the first time in a month.

There was a 7,200 increase in the UK unemployment claimant count from a revised 7,000 increase the previous month with the unemployment rate unchanged at 8.4%. There was a further decline in average earnings growth to 1.4% from 1.9% according to the latest data with a notable squeeze in government-sector earnings which maintained fears that consumer spending would come under pressure over the next few months.

Fitch also revised the UK credit-rating outlook to negative which unsettled Sterling to some extent, although the impact was measured as Moody’s took a similar stance last month with Sterling back towards 1.5650.

Swiss franc

Despite being generally on the defensive against major currencies, the Euro pushed significantly higher against the Swiss currency during the day with a peak close to 1.2150 before correcting slightly weaker. The dollar was also able to push above the 0.93 level.

The Swiss ZEW index rose to a figure of unchanged for February from a figure of -21.2 the previous month which maintained some expectations of an underlying improvement in the economy.

There were expectations that the National Bank would reinforce its commitment to a weak Swiss franc at Thursday’s monetary policy meeting with volatility set to increase.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

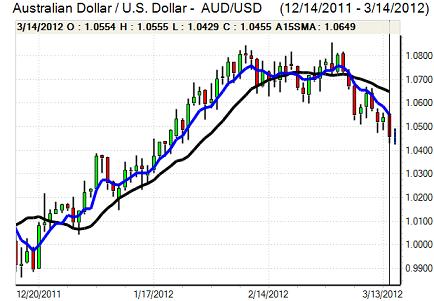

The Australian dollar lost support in the 1.05 region against the US currency on Wednesday and dipped to the lowest level since late January at close to 1.0430 before a limited corrective recovery.

There were increased concerns surrounding the Asian economic outlook following China’s cautious tone and there was further selling pressure on the Australian dollar against the Canadian dollar as North American optimism increased at the expense of Asia

The domestic economic data did not have a major impact with a small increase in inflation expectations and the Australian currency managed to find further support below the 1.0450 region against the US currency.