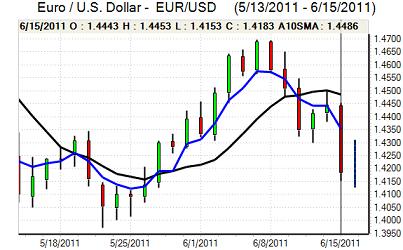

EUR/USD

The Euro was unable to regain the 1.44 level in Europe on Wednesday and was subjected to heavy selling pressure during the day as the fundamental outlook continued to deteriorate and risk appetite weakened sharply.

There were further market concerns over the Greek outlook, especially after the reports that differences of opinion may prevent any solution until July. Within Athens, there were huge protests against austerity measures and the government announced that it would hold a confidence vote on Thursday in an attempt to gain a fresh mandate. If the government is defeated there will be further domestic destabilisation which would make it even more difficult to agree a second rescue package.

Reports continue to suggest that the German government is insisting that private bond-holders accept losses as part of any fresh support package while the ECB remains heavily opposed to any measures which would constitute a default. Although other European governments appeared to be moving closer to the ECB position, there will be no deal without German agreement. Market fears over instability and default continued to increase which put the Euro under pressure.

Additionally, the Irish government stated that it had asked for IMF support to impose haircuts on senior bondholders of Irish banking-sector debt. Such a move would increase wider fears over imposed losses and there were further fears over the European banking sector.

The US growth-related data was weaker than expected as the New York manufacturing PMI index weakened to below zero for the first time since November 2010 with a drop to -7.8 from 11.9 previously while the NAHB housing-sector index fell to 13 from 16 previously. There was a higher than expected core inflation reading, but safe-haven considerations dominated and there was defensive demand for the dollar as US Treasury yields declined. In this environment, the Euro came under heavy selling pressure with lows below 1.42 as it recorded the sharpest decline since last August.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar spiked higher against the yen in early US trading on Wednesday and, despite a decline following the US data releases, the US currency managed to resist further losses with a move back towards the 81 level. The yen did secure support on the crosses with the Euro retreating to below 115.0.

There was defensive demand for the yen as risk appetite deteriorated, but the dollar was able to resist fresh losses even with a decline in bond yields as unease over the threat of intervention curbed yen buying.

Domestically, there was a reported improvement in manufacturing confidence according to the latest tankan survey and the government retained a slightly more optimistic tone surrounding the outlook which provided some yen support.

Sterling

The headline UK claimant count data was weaker than expected with an increase of 19,600 for May from a revised 16,900 increase the previous month. There was a decline in the unemployment rate as there was an increase in part-time employment. The data as a whole will maintain unease over growth trends.

In his Mansion House speech on Wednesday, Bank of England Governor King maintained a generally downbeat assessment of the economic outlook and also referenced to very weak growth in money supply. There will be continuing expectations that the central bank will resist pressure to increase interest rates as it believes that domestically-induced inflationary pressure remains very limited.

Sterling remained vulnerable on yield grounds, although international trends dominated with wider dollar gains pushing Sterling to lows below 1.62 against the dollar. The UK banking sector will remain an important focus and there will be fears over renewed losses if EU governments cannot prevent debt defaults.

Swiss franc

The dollar found support near 0.8450 against the franc on Wednesday and pushed sharply higher with a peak near 0.8550 during New York trading as the US currency secured wider gains. The dollar and franc both advanced strongly against the Euro, but the franc lagged behind to some extent as volatility remained at high levels.

There was caution ahead of Thursday’s National Bank policy meeting with a reduction in aggressively-long speculative positions. The franc will gain sharply if interest rates are increased while an announcement of fresh intervention would weaken the currency sharply. The most likely outcome is that the central bank will look to verbally curb franc gains without fresh policy action.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

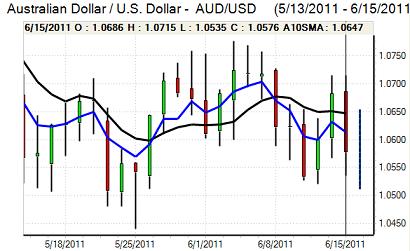

Australian dollar

The Australian dollar stalled close to 1.07 against the US currency during Wednesday and then retreated rapidly during the US session with lows below 1.0550 before some stabilisation in Asia on Thursday.

The Australian currency was undermined by a sharp deterioration in risk appetite as equity markets also retreated sharply. The currency remained vulnerable on unease over the threat of weaker global demand as commodity prices fell sharply during the New York session.

Yield considerations will remain important and there was evidence of bargain hunting at lower levels which provided some protection.