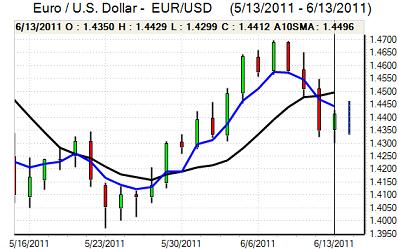

EUR/USD

The Euro found support in the 1.4310 region against the dollar during Monday and, despite sharp retreats at times, the currency rallied back to a peak near 1.4440 in Asia on Tuesday.

There was some improvement in risk appetite which curbed defensive demand for the US currency, especially as there were no negative surprises from the latest batch of Chinese economic data releases.

There were further market concerns over the Euro-zone situation with no resolution to the Greek debt crisis. The severity of the situation was illustrated by a further sharp ratings downgrade. Standard & Poor’s cut the Greek rating to CCC from B which implies a very substantial default risk. The German government is still insisting that there needs to be a rescheduling of private-sector debt as part of a rescue package while the ECB remains opposed to any solution which implies any form of debt restructuring as this would severely compromise the ECB solvency position. Confidence will remain extremely fragile as officials battle to find a solution before the June 23-24 economic summit.

In comments on interest rates, Trichet stated that an interest rate increase in July was likely, but was not certain. If the inflation data later this week is weaker than expected, there will be further pressure for a more relaxed ECB stance on inflationary pressure which would lessen Euro support.

The US data will be watched closely on Tuesday and a weaker than expected retail sales report would increase fears over a renewed US downturn. Although immediate global risk conditions have stabilised, the dollar could still gain defensive support from signs of weaker global demand. There has also been a renewed increase in long speculative Euro positions which will maintain the potential for fresh selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed to a high above 80.60 against the yen on Monday, but was unable to sustain the gains and weakened back to the 80.10 area before finding support as speculation over G7 opposition to a stronger yen curbed buying demand for the Japanese currency.

There was some improvement in international risk appetite which curbed immediate demand for the yen on the crosses, but the dollar was hampered by an important lack of yield support, especially with expectations of a lacklustre US retail sales report.

The Bank of Japan held interest rates at 0.1% following the latest council meeting and there were no additional measures by the central bank. Underlying confidence in the economy will remain extremely weak, but there will still be a suspicion of capital repatriation which will provide significant net yen protection.

Sterling

Sterling found support below 1.6230 against the dollar during Monday and rallied to a high close to 1.6420 in Asian trading on Tuesday as it also strengthened through 0.88 against the Euro.

The latest housing data was weaker than expected with the RICS index registering a net balance of -28% for May from -21% the previous month, reinforcing expectations of a weaker housing sector as prices come under downward pressure.

MPC member Weale stated that he still wanted an early rise in interest rates to contain inflation which maintained some caution over selling Sterling aggressively, although expectations are for the central bank to leave interest rates on hold over the next 2-3 meetings. There was Sterling support from underlying fears over the Euro-zone economy with some potential for defensive capital inflows. Volatile trading will remain an important risk given the underlying UK fundamental vulnerability with sentiment liable to fluctuate rapidly.

Swiss franc

The dollar pushed to a high above 0.8450 against the franc during Monday, but was unable to hold the advance and retreated to test support below 0.8350 before finding support. There were further sharp moves on the crosses with the Swiss currency strengthening rapidly to a record peak near 1.20 against the Euro following the downgrading of Greece’s credit rating and a warning from the Swiss business federation that the franc could move to parity against the Euro.

Safe-haven considerations will inevitably remain extremely important in the short term with stresses within the Euro-zone triggering further capital flows into Switzerland.

There will be further pressure on the National Bank to stem franc appreciation at this week’s monetary policy meeting with high volatility likely to remain a key feature.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

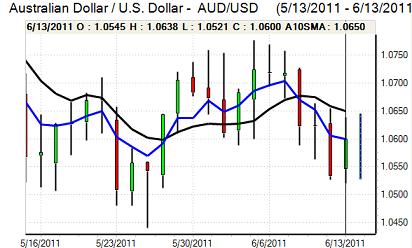

Australian dollar

The Australian dollar found support on dips towards 1.0520 against the US currency during Monday and rallied firmly to a high near 1.0640 in local trading on Tuesday as volatility remained high.

There was relief over the Chinese economic data which increased hopes for a controlled slowdown in growth and there was an overall improvement in risk appetite which also helped underpin the Australian currency. There was also evidence of a squeeze on short positions which helped push the currency higher. Overall confidence is still liable to be very fragile given the underlying international and domestic stresses.