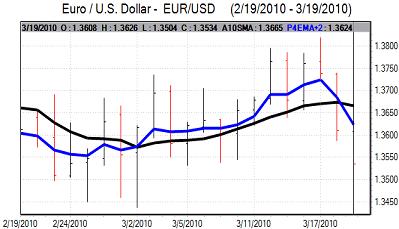

EUR/USD

Although the Euro gained some support from a covering of short positions on Friday, it was trapped near the 1.36 level in early Europe as sentiment remained generally weak.

There were further market concerns over the Greek debt situation during the day. There were further stresses within the German coalition and this fuelled further speculation that the Euro-zone countries would not be able to secure an internal agreement to provide fiscal support and would instead push for IMF support. Evidence of friction between the French and German governments was also a negative factor for market confidence during the day.

There were no US economic data releases during the day and there was some further speculation over a further near-term increase in the Fed’s discount rate which helped underpin the US currency.

Given the lack of economic data, an interest rate increase from the Reserve Bank of India caused more reaction that usual. The tightening had a negative impact on risk appetite which also tended to support the dollar, although a reduction in long positions in risk assets ahead of the weekend is also likely to have been an important factor.

The Euro weakened to a two-week low close to 1.35 against the dollar before correcting higher as strong bidding interest appeared at lower levels.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk conditions held steady on Friday, but the yen was still able to resist selling pressure. There was further speculation over capital repatriation ahead of the fiscal year-end with potential flows liable to continue next week.

There was also further caution over Chinese monetary policy given the possibility of further tightening and persistent tensions over the yuan’s level. The dollar continued to hit resistance above 90.50 against the yen with buying interest near 90.

The dollar was trapped within familiar ranges later in the day with the yen holding firm on the crosses as the Euro retreated towards the 122 region.

Sterling

Sterling hit selling pressure close to 1.5250 against the dollar on Friday and weakened steadily during the day. The currency was undermined by domestic fears and a generally firmer dollar.

MPC member Sentance stated that there was some risk of a UK double-dip recession which undermined Sterling confidence, especially as he also commented that fiscal policy would need to be tightened considerably over the next year.

Failure to prevent a strike by British Airways also had some negative impact and there was a reluctance to hold long positions ahead of the weekend given unease over further negative media coverage while markets were closed.

Sterling dipped to lows just below 1.50 against the dollar before stabilising while the UK currency also weakened to lows near 0.90 against the Euro.

There will be further caution ahead of the annual budget release due next Wednesday which will tend to dampen Sterling buying support.

Swiss franc

The dollar found support below 1.0550 against the Swiss franc on Friday and managed to hold above 1.06, although gains for the US currency were still measured.

The Swiss currency remained strong on the crosses with the Euro sliding to lows below 1.4350 against the franc and approaching record lows seen during the financial crisis during 2008.

Again, there was no evidence of National Bank intervention which reinforced speculation that the bank was now more tolerant of currency gains, especially after bank member Danthine’s comments on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

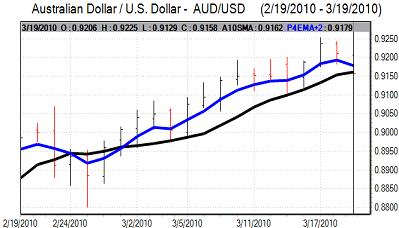

Australian dollar

The Australian dollar was blocked around 0.9220 against the US currency on Friday and was subjected to moderate selling pressure during the New York session with lows near 0.9160. Commodity prices were generally weaker during the day which curbed buying interest for the Australian currency.

Risk appetite was slightly weaker following the Indian interest rate increase and there was further speculation that China could announce further monetary tightening measures during the week. There was still some evidence of buying support on dips which curbed losses.