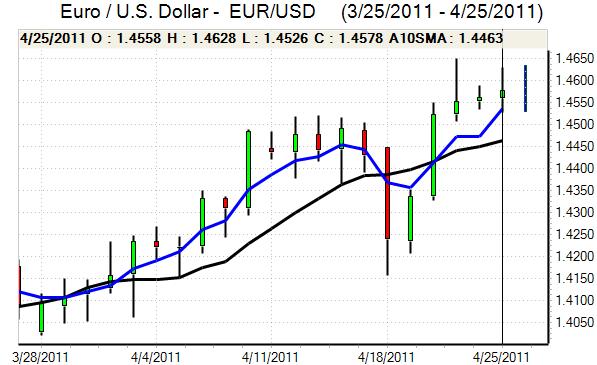

EUR/USD

After very narrow ranges on Friday, the Euro initially moved higher on Monday with a test of resistance close to 1.4625, but it then retreated quickly back to the 1.4550 area as moves remained subdued. A stronger than expected reading for US new home sales did not have a major impact with little expectations that it would change Fed policy expectations. ECB President Trichet stated that a strong dollar was in the US’s interest and there will be speculation that G7 will look to stabilise markets through verbal intervention.

There were reports that IMF officials will lead a delegation to Greece within the next two weeks to discuss the debt burden and possible solutions and the talks will inevitably include potential debt restructuring. The simple fact remains that without some form of restructuring, Greece will eventually default on sovereign debt. There will be further market fears over the impact of European banks as the bad-debt burden would increase further.

The principal US focus will be on Wednesday’s Federal Reserve FOMC statement and press conference from Bernanke. There will be strong expectations that the Fed will leave interest rates at extremely low levels, but will not extend the current phase of quantitative easing. Markets will also be on high alert for comments on the US government-debt situation and whether there are direct references to the US dollar. There have been some expectations that there will be G7 action to stabilise currencies.

There will certainly be a mood of caution ahead of the decision even with underlying dollar sentiment liable to remain weak and there was evidence of short positions being covered and after another failure to break above 1.46, the Euro retreated to test support below 1.4520 in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar jumped sharply higher to a peak around 82.40 against the yen in Asia on Monday. Risk appetite remained relatively strong which encouraged speculation over additional carry trades and there were also expectations of increased overseas investment by Japanese funds.

There were also expectations that the Bank of Japan would need to maintain a highly expansionary policy at its meeting this week even if there are no further policy announcements.

Asian currency policies will remain in strong focus and there was no weekend move to revalue the Chinese yuan which had some initial impact in weakening the yen. The underlying pressure for Chinese action will continue and there was also upward pressure on Asian currencies as a whole which will tend to limit yen selling pressure. A correction in metals prices also triggered caution on Tuesday with the dollar retreating to the 81.65 area.

Sterling

Sterling briefly spiked to highs above 1.6550 against the dollar on Friday and on Monday, but quickly retreated with a test of support near 1.65 during Monday as the Euro consolidated above the 0.88 level.

Risk conditions remained important for the UK currency and a slightly more defensive global tone stifled UK currency support in Asia on Tuesday with lows around 1.6450 against the dollar.

The UK GDP data release for the first quarter is due for release on Wednesday and will receive substantial market attention. There will be the risk of another erratic release after the shock 0.5% contraction the previous quarter and volatility is liable to spike higher again following the release. Unless the data is very strong, underlying fears surrounding consumer spending levels continue to restrict the Bank of England’s options in raising interest rates and this will also tend to limit Sterling support.

Swiss franc

The dollar initially found support just below 0.88 against the franc during Monday with US moves dampened to some extent by franc moves on the crosses. Later in the session, the Euro was subjected to selling pressure on the crosses which again lessened scope for any significant dollar advance.

Risk conditions were supportive on Monday with equity markets attempting to make headway which dampened defensive franc demand, but there will still be a lack of confidence in the major currencies which will maintain underlying support for the Swiss currency. The Euro-zone debt fears will also remain an important factor supporting the franc with the dollar still unable to gain much traction on Tuesday as risk appetite was more fragile.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

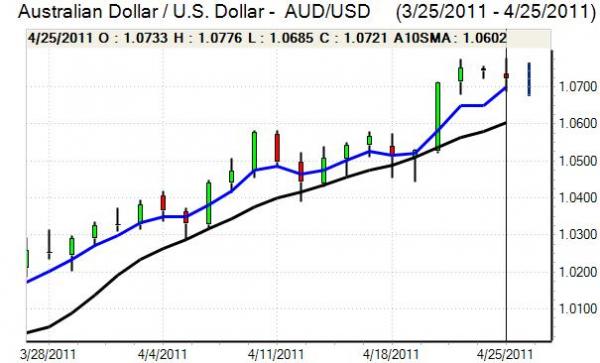

Australian dollar

After a brief surge to the 1.0775 area against the dollar on Monday, the Australian currency retreated back to the 1.0725 area in choppy trading conditions. Domestic markets remained shut on Monday and Tuesday which limited trading volumes and maintained choppy conditions.

Risk conditions will remain very important in the short term and there will be further pressure for Asian currency appreciation which will tend to limit support for the Australian dollar. Yield considerations will remain a significant support factor in the near term, but volatility is liable to remain a key feature with a retreat to the 1.0680 area in Asian trading on Tuesday.