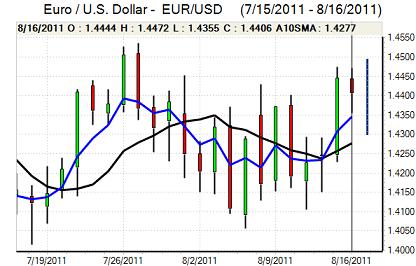

EUR/USD

The Euro found support on dips towards 1.4350 against the dollar on Tuesday and tested resistance levels above 1.4430, but it failed to hold the gains. The currency was still gaining significant support from a firm tone against the Swiss franc.

The Euro-zone GDP data was weaker than expected with German second-quarter growth of 0.1% compared with expectations of a 0.5% gain and this helped drag Euro-zone GDP expansion to 0.2% from 0.8% previously which maintained fears over a sharp slowdown in the economy

There was further market speculation over the issuance of Eurobonds ahead of the meeting between German Chancellor Merkel and French President Sarkozy. In the event, the meeting rejected the issuance of bonds at this stage with a concentration on measures to strengthen governance such as tighter rules on budget deficits.

There was also further strong political opposition to Eurobonds from The German coalition FDP partners and there is also substantial opposition within Merkel’s CDU party as well as countries such as Finland and the Netherlands. Near-term pressure for ECB bond purchases will continue as underlying tensions remain high.

The US housing data was close to expectations with starts dipping slightly to an annual rate of 0.60mn for July from a revised 0.61mn previously while permits were also slightly weaker. In contrast, there was a stronger than expected reading for industrial production with a monthly increase of 0.9% as capacity use also increased.

Ratings agency Fitch affirmed its AAA rating for the US and also maintained a stable outlook, in sharp contrast to the Standard & Poor’s analysis. The data and rating provided some support for the dollar, but the impact was offset by firmer conditions for risk appetite. The Euro retreated following the decision not to introduce Eurobonds, but there was support on dips towards 1.4350.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was again confined to very narrow ranges during Tuesday as market attention remained focussed on Europe. Although there was dollar support close to the 76.65 area, it was unable to break above 77.

The dollar did gain support from the better than expected industrial data and Fitch’s rating announcement, but it failed to sustain the gains as yield support was still extremely weak. Fed Governor Bullard stated that the commitment to maintaining very low interest rates was not an indicator of further quantitative easing and this should provide some degree of dollar support.

Underlying risk appetite was slightly weaker in Asia on Wednesday as equity markets weakened and this capped any selling pressure on the yen.

Sterling

Sterling found support on dips towards 1.6320 against the dollar on Tuesday and secured solid gains with a peak around 1.6470 as the UK currency was also able to strengthen to test resistance beyond 0.8750 against the Euro.

Headline consumer prices inflation rose to 4.4% for July from 4.2% which was slightly stronger than expected while the core rate rose to 3.1% from 2.8%. With inflation again outside the 1-3% range, Bank of England Governor King was forced to write a letter of explanation to the Chancellor.

King remained concerned over the inflation outlook, but was more worried over the potentially severe risks posed to the economy by the Euro-zone crisis. The latest employment data and Bank of England minutes will be watched very closely on Wednesday with a particular focus on whether there was additional support for quantitative easing.

At this stage, the most likely outcome is that the central bank will wait and assess developments which could provide some Sterling support, although yields remain exceptionally unattractive at current levels.

Swiss franc

The dollar found support below 0.78 against the franc on Tuesday and strengthened sharply to a peak near 0.80 while the Euro also rallied strongly to a high near 1.15. The franc lost support on an improvement in risk appetite, although the main focus was still on potential measures to address franc strength by the Swiss government.

There will be a meeting on Wednesday to address fresh measures which may be followed by a press conference. There was further speculation that some form of peg to the Euro or a minimum rate for the Euro will be considered. There will also be the possibility of a tax on bank deposits. Franc volatility is likely to be extremely high following the meeting whatever the outcome, especially as there are still major market concerns over the Euro-zone outlook.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

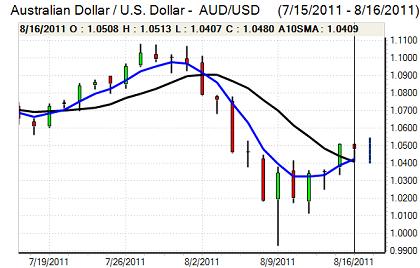

Australian dollar

The Australian dollar again found support on dips to the 1.04 area against the US currency during Tuesday and rallied to test resistance levels near 1.05 in choppy trading conditions. The domestic data did not have a significant market impact with little change in the MI leading index. Expectations that the Reserve Bank would move to a looser policy stance was offset by the continuation of extremely low US interest rates.

Asian equity markets were slightly weaker on Tuesday as markets remained uneasy over the Euro-zone outlook, but the mood was calmer which curbed any selling pressure on the Australian currency.