EUR/USD

The Euro sustained a generally firm tone on Friday, maintaining the tone seen during the week as a whole. There was some easing of European debt concerns following a successful Spanish bond auction while there was some degree of optimism surrounding the European banking-sector stress tests. There was also some further underlying support from a closing of speculative short Euro positions.

There were no significant Euro-zone economic data figures during the day while there were also no releases within the US economy either. There was further speculation that the US economy would slow during the second half of 2010 and this continued to have some negative impact on confidence surrounding the US currency.

The Federal Reserve interest rate decision will be watched closely on Wednesday with a particular focus on the statement given that rates are unlikely to be moved at this meeting. The dollar will find it very hard to make any headway unless the Fed moves towards a tightening bias.

The Euro hit resistance above 1.24 on Friday and drifted back to the 1.2370 area. There were renewed Euro gains in Asian trading on Monday following the Chinese decision to end the peg against the dollar. This decision helped boost confidence in the global economy and increased speculation that there would be reduced dollar demand and this allowed the Euro to strengthen to the 1.2450 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to the 90.50 area against the yen in European trading on Friday, but was unable to make much headway and was blocked below the 91 level. Underlying selling pressure on the yen was subdued despite a general mood of confidence in carry trades. There was some speculation that the new Japanese administration would be able to make headway on reform and strengthen the economy’s long-term potential.

The announcement by Chinese officials that the yuan would be allowed greater flexibility pushed the dollar weaker in Asia on Monday with a general increase in confidence surrounding Asian currencies.

The impact was measured as there was also an improvement in risk appetite with speculation that the Chinese move signalled grater confidence in the Chinese and global economic rebound. The dollar dipped to the 90.25 area.

Sterling

Sterling maintained a resilient tone against the dollar in early Europe on Friday, but was unable to sustain a move above 1.4880.

The latest government borrowing data was slightly better than expected with a monthly shortfall of GBP16bn for May compared with expectations of a deficit just over GBP18bn. The UK government budget statement will be watched very closely on Tuesday and there is likely to be aggressive action to curb the deficit with a combination of spending reductions and tax increases.

There will be relief that action is being taken, especially as it should lessen the risk of a credit-rating downgrade. There will, however, also be fears that the economy will be pushed back into recession which will limit scope for any Sterling support.

Sterling found support below 1.48 against the dollar and pushed to test highs above 1.4850 on Monday due to wider US weakness following the Chinese currency move.

Swiss franc

The dollar was unable to make significant headway on Friday with resistance above the 1.1120 area. The US currency was again hampered by general franc strength with the Euro losing support near 1.3750.

There will be further speculation that the National Bank will be more reluctant to intervene in the market and sell the franc over the next few weeks. There will be some unease that the franc has reversed recent declines against the dollar and further US weakness would make it much more likely that the bank will intervene in the market to curb franc gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

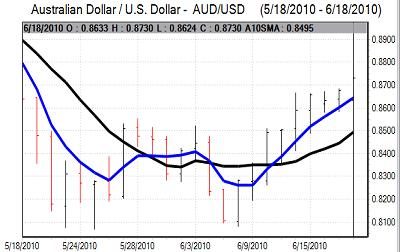

Australian dollar

The Australian dollar found support above 0.8650 against the US currency on Friday and moved back to the 0.87 area later in the US session. Underlying risk appetite remained firm which helped curb any selling pressure on the Australian currency during the day.

The Australian dollar drew strong support from the Chinese currency move in early Asian trading on Monday and there was an advance to a high above 0.8820 against the US currency.