EUR/USD

The Euro was unable to hold above 1.23 against the dollar in early Europe on Thursday and had a steadily weaker tone during the day.

There were further stresses within the European bond markets during the day with the spread on Spanish bond markets rising to a record high since the Euro’s launch in 1999. On the economic front, there was also a decline in Euro-retail sales which maintained market fears over a renewed downturn in the region’s economy. There were also expectations that the ECB would increase liquidity as stresses continued in money markets.

The US economic data was broadly in line with market expectations and failed to have major impact. Initial jobless claims fell to 453,000 in the latest reporting week from 463,000 previously. The ADP report also recorded 55,000 employment growth for May following a revised 65,000 gain the previous month.

The ISM index for non-manufacturing was little changed for the month at 55.4. The employment component edged above the 50.0 level which will maintain expectations of a solid underlying gain in Friday’s payroll data. With the figures bolstered by temporary census employment, there are expectations of employment growth of at least 500,000 for the month.

There will still be some unease over the risk that momentum within the services sector will deteriorate rapidly, especially as consumer credit conditions are still tight. The Euro drifted to lows just above 1.2150 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a firm tone in Asian trading on Thursday as there was still solid interest in selling the Japanese currency. The latest capital spending data recorded a 11.5% annual decline for the first quarter. There was evidence of significant exporter dollar selling and this capped the scope for dollar gains with resistance on approach to the 92.50 area.

The US currency extended its advance to the 92.80 area later in the US session, but again struggled to extend the gains as advances in equity markets stalled. There was also some evidence of profit taking following the recent dollar gains while persistent doubts surrounding the global economy limited yen selling pressure. The Euro also stalled above the 114 level against the Japanese currency.

Sterling

Sterling again hit resistance above 1.47 against the dollar in early Europe on Thursday with a solid Nationwide house-price index providing some degree of support.

The UK PMI index for services was little changed at 55.4 for May, but the new business component was at a nine-month low. Following the weakness in consumer credit reported on Wednesday, there will be further unease over the risks of a renewed economic downturn during the second half of 2010.

Sterling edged lower against the dollar during the day, undermined by a wider loss of support for European currencies ahead of the US payroll data.

There was an underlying lack of confidence in the UK policy framework which curbed demand for Sterling and there was a low below 1.46 later in the US session. The UK currency held firm against the Euro and edged towards the 0.8320 area.

Swiss franc

The dollar found support close to 1.15 against the franc on Thursday and moved slowly high towards 1.1570 during New York trading. The Euro was subjected to renewed selling pressure against the Swiss currency and it weakened to near 1.4050.

The widening of Euro-zone benchmark spreads will continue to provide underlying support for the Swiss currency as the Euro will continue to find it very difficult to gain sustained relief given fears over Euro-zone fundamentals.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

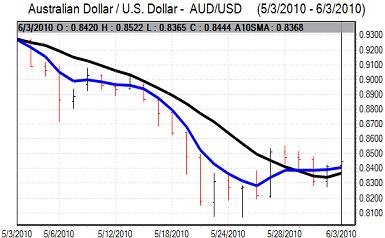

Australian dollar

The Australian dollar strengthened steadily to a high of 0.85 in early Europe on Thursday. There was a general advance in stock markets which was important in boosting risk appetite and supporting the Australian dollar, especially with the yen under general selling pressure.

The PMI index for the services sector weakened to 47.5 for May from 52.3 previously and this was the fourth month in 2010 with a figure below the 50.0 benchmark level. The data will tend to cast important doubts over the domestic economy and the prospect for higher interest rates which will limit the scope for Australian dollar support. In this context, the Australian currency weakened to a low near 0.8370 before a rally back above the 0.84 level.