EUR/USD

The Euro was unable to gain any traction during Friday and weakened further during the day with lows below the 1.32 level against the dollar before stabilising at lower levels.

There were further uncertainties surrounding Greece with concerns surrounding the private-sector debt restructuring take-up rate. A low rate would force Greece to trigger the Collective Action Clause to force compliance and this would substantially increase the risk of Greece finally being declared in default by the ISDA which would lead to CDS payouts fresh fears over market turbulence.

Spain was the main focus of attention on Friday as the government announced that the 2012 budget deficit target would be revised to 5.8% of GDP compared with the previous objective of 4.4%. The government also sharply downgraded the GDP forecast as it expected a further contraction of over 1.5% for the year. By increasing the deficit forecast, Spain has broken the EU guidelines and there will be further doubts over the increased target if there is a further GDP contraction. Spain’s action was particularly badly timed given that the fiscal compact was signed earlier in the day and fears surrounding Euro-zone structural vulnerabilities increased even though there were reports that the EU had approved the forecast.

There were no significant US data releases during the day with markets subdued ahead of this week’s payroll report with the ISM non-manufacturing data due on Monday.

The latest IMM positioning data recorded a significant decline in short Euro positions which will lessen the threat of a renewed squeeze on short positions, although positioning is still substantially short. The Euro continued to find support below 1.32 on Monday in tentative trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar continued to find firm support against the yen on Friday and pushed significantly higher later in the US session with a fresh 7-month highs near 81.90. Wider yen vulnerability also helped provide some degree of protection for the Euro on the crosses.

The dollar continued to gain support on yield grounds with expectations that the US economy would continue to out-perform in the near term. The latest speculative positioning data recorded a switch to a slight net short yen position which will lessen the risk of more aggressive yen selling.

The HSBC non-manufacturing data was stronger than expected at 53.9 which helped underpin confidence, but the impact was offset by a lower government GDP growth target of 7.5% which dampened risk appetite. The dollar hit resistance close to the 81.80 area on Monday and slipped back to the 81.25 region.

Sterling

Sterling was unable to make a fresh attack on resistance in the 1.60 zone against the dollar on Friday and dipped sharply early in the US session with stop-loss selling on a break of 1.59 which triggered lows below 1.5850. Sterling was still able to maintain a firm tone against the Euro with a figure around 0.8335.

The construction PMI index increased to 54.3 in the latest month from 51.4 previously which helped maintain a slightly more optimistic tone surrounding the economy. The services-sector data due on Monday will provide a sterner test of UK economic resilience and any significant downturn would trigger a fresh assessment of market opinion.

The UK currency remained on the defensive against the dollar on Monday with a brief test near 1.58 as underlying risk appetite was slightly weaker. There is still the possibility of safe-haven demand from renewed stresses within the Euro-zone as volatility is liable to increase.

Swiss franc

The dollar was able to resist any significant downward pressure on Friday and pushed to highs near 0.9150 before stabilising. The Euro was able to resist a renewed test of support towards 1.2050 and rallied to the 1.2065 area with ranges on the Euro still narrow as rallies attracted selling.

Any fresh turbulence within the Euro-zone would risk fresh selling pressure on the Euro against the Swiss currency and sentiment will remain generally cautious. National Bank actions will remain a very important focus in the short term if the peg is subjected to fresh pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

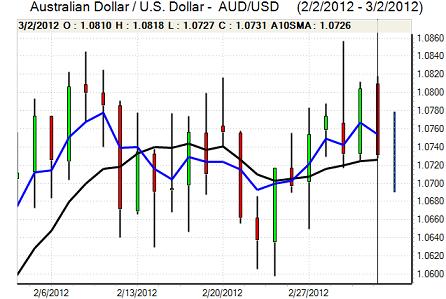

Australian dollar

The Australian dollar initially found support in the 1.0750 area against the US currency on Friday, but it was unable to challenge the 1.08 region and was subjected to renewed selling late in the US session and dipped to just below 1.0750.

Domestically, there was a weaker reading for the PMI services-sector data while operating profits also fell sharply in the latest quarter. Markets are expecting the Reserve Bank to leave interest rates on hold at Tuesday’s interest rate decision with some degree of caution ahead of the announcement.

A lowering of China’s GDP growth forecast maintained a cautious attitude towards risk appetite and curbed Australian dollar demand.