The dot-com boom of the late 1990s transformed millions of individual investors into highly-engaged stock traders. After the internet bubble burst in 2000, these active investors wanted to stay in the market if they could better manage the risk they accepted for each trade. Equity options were the answer, but the marketplace wasn’t ready: Equity options were predominately traded on exchange floors, with very wide bid/ask spreads and slow execution, and brokers were not providing the technology, resources, education or customer support required for investors to succeed.

The tide began to turn when the all-electric International Securities Exchange stepped into this void, forcing the Chicago Board Options Exchange to follow, as well as new online brokers, namely optionsXpress (later bought by Schwab) and Thinkorswim (later bought by Ameritrade).

Soon after, the vast majority of equity options were being traded electronically, all of the online brokers were offering powerful options trading tools, and the “average” investor was learning not just about covered calls, but condors, butterflies and ratio spreads.

Through this equity options revolution, futures options stubbornly remained in the past – they remained pit-based, spreads were large, liquidity was lacking, and online brokers were stuck with decade-old legacy trading platforms.

Thankfully, there are many signs that this is beginning to change. In fact, factors very similar to those that drove the widespread adoption of equity options are now in place with futures options, heralding in the introduction of these powerful tools into investor portfolios.

These factors include:

Heightened Investor Interest in Commodities

Just as the dot-com boom brought millions of investors to stock trading, the success of managed futures during the 2008 meltdown and heightened interest in portfolio diversification has brought renewed attention to the commodities markets. When combined with constant media coverage of gold, crude oil, inflation fears and economic uncertainty, interest in commodities is skyrocketing.

Electronic Trading of Futures Options Is Trending Upward

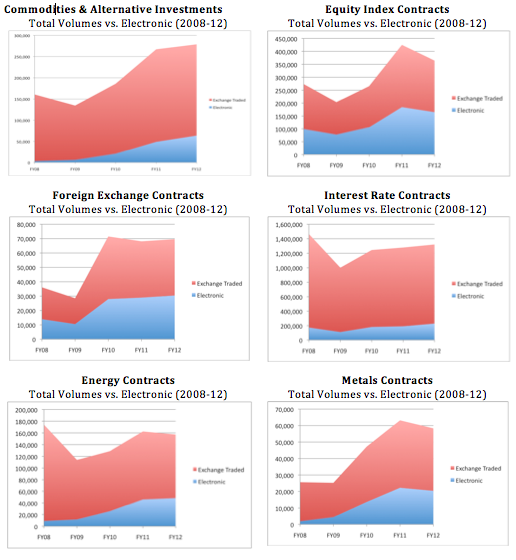

Although 90% of all futures contracts are now executed electronically, options on futures have been slow to move “to the screen.” In fact, depending upon the product, the majority of futures options volumes are still traded in the pits. This is the same disconnect we saw in equities in the mid- to late-1990s, as electronic execution helped stock trading volume skyrocket, while pit-based equity options caused their growth to lag. However, the last four years show that the landscape is inexorably shifting towards electronic trading of futures options.

Change is being forced by competition, as leading exchange companies, the CME Group and IntercontinentalExchange (ICE), are each taking aggressive steps to grab new customers and to be more compelling venues for a limited number of institutional trading dollars. In fact, ICE now trades all futures options electronically, and with that exchange’s acquisition of global exchange powerhouse NYSE Euronext, the transition to electronic futures options trading is expected to accelerate even faster.

Current Commodity Investment Vehicles Fall Short of Expectations

Managed futures’ success as an investment class in 2008 caused many investment firms to create many investor-friendly managed futures-like mutual funds and ETFs. In fact, from 2004 to 2011, assets under management in commodity-based ETFs grew from slightly more than $1 billion to $118 billion.

The explosion in these ETFs and mutual funds may indicate success for the investment firms, but it did not translate to success for the investors. Many investors were stunned to see their ETF values to fall even as the underlying commodity was moving up (this is explained in all of its mathematical and academic glory by the CME Group).

As Bloomberg Businessweek noted in a 2010 article, “Amber Waves of Pain,” a review of ten well-known commodity funds found that all of them trailed in performance to the underlying raw materials they were based upon. When that article was written, the $1.9 billion U.S. Oil Fund (USO) had dropped in value 50%, while the value of crude oil, the underlying commodity, had climbed 11%. Additionally, the U.S. Natural Gas Fund fell 85% since its launch, more than double the 40% fall of natural gas.

Equity Options Traders Pushing Change

Thinking that an ETF investor will jump right into trading futures options is a bit of a stretch. What is not a stretch is the idea that many of the millions of investors now trading equity options will look to get commodity exposure via futures options, as opposed to ETFs, mutual funds or resource companies. And if we learned anything from the equity options boom, it is that the retail investor has a very loud voice, and exchanges and brokers will listen to their demands for electronic execution, more liquidity and better pricing.

What does the future hold? Clearly, no one knows for certain, but based on these powerful forces, we are likely to see an explosion in interest – and opportunities – among individual investors who will quickly learn just how powerful futures options can be as a more efficient and cost effective tool to generate exposure to the commodity markets.

= = =

Read a related article here: