As expected, the Reserve Bank of Australia (RBA) maintained the cash rate at 3.5% for a third consecutive month. The rate statement was relatively upbeat as sustainable growth remains in Australia, even with comments about increased uncertainty in the global economy, a contracting Europe, and a China that is slowing down from its exceptional pace.

The RBA cut interest rates twice last year and once this May. The central bank will require further domestic economic weakness before acting to ease.

RBA LIKELY ON HOLD TIL DEC

Expectations are diminishing of a rate cut rate before year-end, but may be triggered sooner if the price for coal and iron ore prices (down around 40% in the past four months) continues to plummet.

Tonight, second quarter GDP will be released, but the key statistic of the week is employment change on Wednesday night. Strong employment statistics have provided support for the Australian dollar. Hints of weaker job news came earlier this morning, when mining giant, Fortescue announced it was slashing jobs and delaying a major expansion plan.

FURTHER WEAKNESS POSSIBLE

A strong miss in Australian jobs, could provide momentum for further bearish price action. While the Aussie is still above parity and even with softer data over the next couple of months, the bank is positioned to stay on hold a little longer. The directional trend is calling for further weakness. However, obstacles may come if an act by the European Central Bank and IMF may cause a jumpstart to the markets and a rally for higher yielding currencies.

THE TRADE

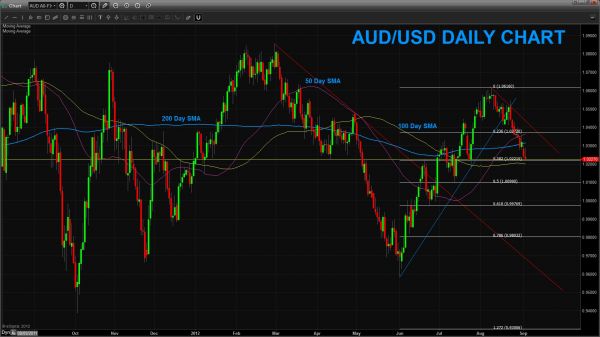

AUD/USD (Daily chart) gapped lower to start the trading week and despite the positive bounce from last night’s rate statement, the pair’s rally has stalled near the 1.0285 region. A continuation of the current bearish trend would be the likely bias as long as the bearish trend line (red) from the August 9 high is respected (near the 1.0360 area).

If instead there is a clean break above this trendline and the 50-day simple moving average, the current downtrend is at risk of ending.

Initial downside targets include the 1.01 level, 50% Fibonacci retracement level of this summer’s low to high move. The next major support level will come at the 61.8% Fibonacci level which is just below parity.