By reading today Caldaro´s EW count view – which indeed is one of the most leading EW analyst when it comes to stockmarket and reasonable major wave degrees, I am having a thought we are entering for very high risk area. His view seems to fit for these currency charts also below. Ie. we have simple A wave down finished with those ABC retracements which is also 38.2% as most typical A wave area to end. Since then we are up now about 61.8% and potentially going to finished B corrective wave with B retracements..

The risk that we are going to fill B wave as next up, once finished can open intermediate C/IV wave down is concurrent.

EurUsd 4H chart Macd divergences are suggesting this also, ie. we have W3/W5 divergence set for it > Higher High with price but lower low with Macd and that was top with 1.4150 at so far.

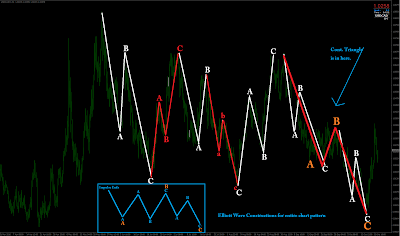

Since it was placed, to express it very simple way market dropped potentially A wave down with 3 series, EurYen did the same for 38.2 area. If as next we saw B wave up or going to see, the risk is pretty significant that C will open by then, to the downside.

But it is not only scenario, these instruments are very wild now as one had seen. My suggestion is to use now UsaCad chart together with “risk-appetit” pairs. Only multiple instruments confirmations opens good charting setups well in EW, at least in FX area.

Edit: Illustraded this situation for 4H UsaCad Chart. It might be look a messy with first sight, but it isn´t. It is suggesting as one ABC pattern only and nothing else, if this is the case, we are potentially dealing with impulsive reversal.