EUR/USD

Over the weekend, Euro-zone Finance Ministers did secure a deal over a EUR110bn Greek support package over the next three years, but the Euro failed to gain strong support with selling pressure above 1.33. There were fears that there could still be problems ratifying the deal in member countries and there are also still persistent fears over the contagion threat.

The ECB announced that it would suspend the collateral requirements for Greek debt. This was a necessary step given the recent credit-rating downgrades and risk of further actions by the agencies, but there will be some fears that the ECB could be forced to compromise its longer-term mandate for stability. Confidence will deteriorate further if there are further rating cuts on other Euro-zone economies over the next few days.

The US ISM manufacturing index was slightly above expectations with an increase to 60.4 for April from 59.6 the previous month. This was the highest level since June 2004 and there will also be optimism that there was a further significant improvement in the employment index

The gains in industrial employment will reinforce expectations of a significant increase in manufacturing employment in Friday’s payroll data. There will also be broad optimism over solid employment report as a whole which would reinforce market expectations that the US economy will out-perform the Euro-zone and provide some dollar support.

The Euro dipped to lows near 1.3150 against the dollar in US trading as the Euro remained under pressure before a consolidation around 1.32. There are a record number of short speculative positions which may provide some degree of Euro protection from further selling.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Japanese markets were closed for a holiday on Monday which stifled activity with the dollar continuing to fluctuate around the 94 level against the yen.

There are still expectations of yen selling on any significant rallies which is preventing the Japanese currency gaining any traction, especially with a lack of confidence in the fundamentals.

The US ISM data reinforced confidence in the US economy and also provided additional yield support for the US currency. In this environment, the dollar pushed to highs near 94.80 before consolidation ahead of the 94.50 region and this was the highest dollar level for 12 months.

Sterling

The weekend opinion polls still suggested a high risk of an indecisive outcome in the general election this Thursday and Sterling drifted weaker to lows near 1.52 in Europe on Monday. UK markets were closed for a holiday which tended to dampen activity.

The support package for Greece had a mixed impact on Sterling as there were some fears that markets would switch to targeting the UK currency now that the immediate risk of a Greek default had been averted.

Sterling found support close to 1.52 and rallied cautiously to 1.5250 later in New York as there were some expectations that a decisive election outcome could be secured. There is still likely to be a high degree of uncertainty over the outcome. The UK currency held firm against the Euro with a peak close to 0.8640.

Swiss franc

The dollar found support close 1.0730 against the franc on Monday and strengthened to a high near 1.0890 as European currencies were subjected to wider pressure before consolidating around 1.0850.

The Euro was trapped in very narrow ranges close to 1.4330 against the Swiss currency and the lack of movement suggested that the National Bank was blocking franc gains stronger through persistent intervention.

The Greek rescue deal is unlikely to provide sustained relief for the Euro which will tend to maintain pressure on the central bank to support the Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

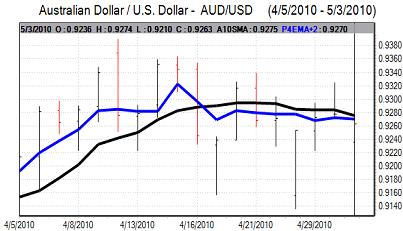

The Australian dollarwas generally resilient on Monday on expectations that the Reserve Bank will increase interest rates again on Tuesday. The currency found support close to 0.9220 against the US dollar and rallied to highs near 0.9270 with some carry-related demand on capital flows out of Japan.

The central bank could decide to leave rates on hold and is likely to be more cautious over any future interest rates which could sap demand for the Australian currency, especially given the amount of favourable news priced in.