While Eur-Usd still leaves everyone uncertain with last W5, I don´t think this one does. It hit today needed fib resistance and also overlapped it. With not exactly 1.6182 but that was very, very close with 1,6085.

Well, promised for you 1.3815 for Eur-Usd by this week with corrective W4 – there it is now in Asian market, missing only 10 pips to reach 1.3815 as 38.2% retracement while EurJpy broke my diagonal it stopped now for 23.6% line.

Eur-Aud banged today reversal impulse also from weekly 1.7675 chart as .618%. I have to confess with this detail I am very suspicious with Eur-Usd is this truncated issue or perhapse this Y / C wave in here does not even break for impulses at all, as there´s so much zigzag´s with it all the way up if we subdive for 1 and 5 minute chart details. Well, nothing new – I am allways suspicious with Eur-Usd, it´s the world most traded & liquid product exist in this universum with zillions of eyedrops & dollars looking the information it creates, but I´ll wait my 1,4262, until that happens trading what I see & not trading if I don´t.

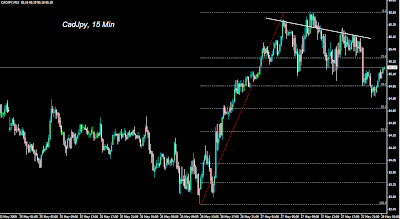

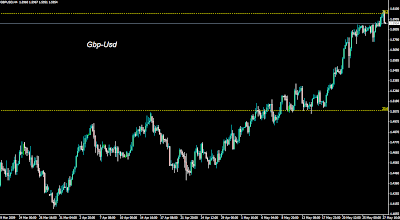

13 different pairs are going to hit dailychart fib resistances and support in next hours, days & weeks, so there´s more action in here as one can follow, but I am short with Gbp-Usd while I am still long with Gbp-Jpy after it broke my 1.51 doublezigzag roof and this is swing. I am long also with CadJpy.

Ah, SPX – we are in corrective bearmarket as we had been for many weeks allready, but I really don´t waste my time to EW label it, it´s too slow zigzag for my taste. My best guess is we will stay this slow correction mode for 4-10 weeks. If it builds easy pattern again as it did on monday – then I´ll chart & take it. If Eur-Usd hits my 1.618 target, then bear should come more quickly.

Oil found SMA200 resistance today, while some other commodites still might have upside roads open like copper – so, there´s messages for all direction in here depends where you looking for. In real big perspective when dealing with FX pairs, everything we basically still do is just consolidating 2008 massive bear impulses – nothing else, all of those fibs where these pairs trading are simply based for those huge, passed impulse roads.

I would generally describe we are living pretty boring times. Hopefully at least Eur-Usd keeps this alive kicking at daily basis as it has done at so far.