By FX Empire.com

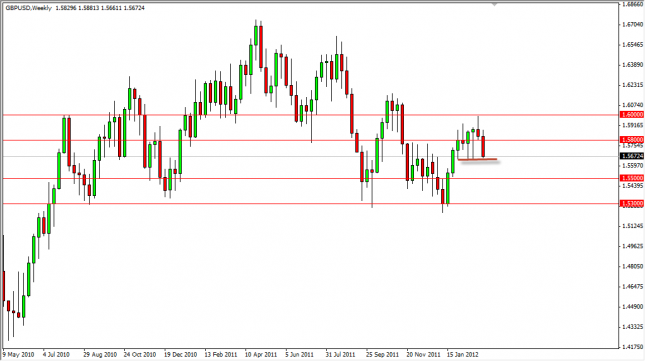

The GBP/USD pair fell fairly hard during the previous week as the 1.58 level gave way. The shooting star from the previous week was the first sign of trouble, and this past week only confirmed the bearishness of the pair.

The British Pound will more than likely continue to struggle as there seems to be a run to the Dollar as the problems in the European Union continue. Yes, the Greeks did finally enter default and this will more than likely trigger further moves in one form or another. Ironically, the markets had enough warning so that the market was pretty well prepared when CDS’ got triggered. (It was after all, the CDS markets that caused the real destruction after the Lehman Brothers collapse a few years ago.) This was shown in the fact that the Euro itself barely moved after the announcement.

The GBP/USD is currently sitting at the 1.5670 level. The area is just above the recent supportive level that we saw in the form of two long wicks on a pair of hammers. This is without a doubt a heavy support area because of this, and the breaking of it would be a significant sell signal to us. We would be more than happy to take this signal, as it shows that the Dollar is gaining over the Pound, and we believe the Dollar to be one of the “safest” currencies at the moment as the world tries to avoid the various financial concerns.

We are selling this pair on a daily close below the 1.5650 level, and aren’t necessarily interested in buying it on a long term chart like this at all, or at least until we get the daily chart to close above the 1.60 handle. In the meantime, we are simply waiting to see if we get that signal lower, and would suspect that the first real target will be the 1.55 level, follow quickly by the 1.53 level. If we get below that – look out below.

GBP/USD Forecast for the Week of March 12, 2012, Technical Analysis

Originally posted here