By FXEmpire.com

GBP/USD Fundamental Analysis April 6, 2012, Forecast

Analysis and Recommendations:

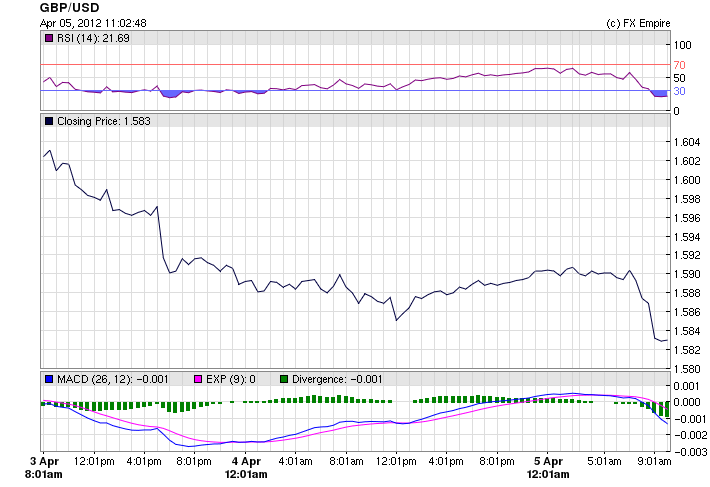

The GBP/USD is currently trading for 1.5820 as the USD was able to mount significant pressure on the pound.

The Bank of England, as widely expected, left its key lending rate unchanged and made no alterations to its 325 billion pound ($516.8) program of asset purchases. The central bank’s key lending rate has stood at a record low 0.5% since March 2009.

Office for National Statistics said manufacturing production fell by 1% in February, slipping below analysts’ expectations of a 0.1% increase.

The Society of Motor Manufacturers and Traders, or SMMT, said Thursday the March new car market beat expectations with a 1.8% rise to 372,835 units, making a a rise of 0.9% over the first quarter.

Across the Atlantic, the number of Americans who filed requests for jobless benefits fell by 6,000 last week to 357,000, the U.S. Labor Department said Thursday. Economists had projected claims would total 360,000. This helped buoy the greenback.

Economic Events April 5, 2012 actual v. forecast

|

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

GBP |

Manufacturing Production |

-1.0% |

0.1% |

-0.3% |

|

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

GBP |

BOE QE Total |

325B |

325B |

325B |

|

BRL |

Brazilian CPI (YoY) |

5.2% |

5.4% |

5.8% |

|

Building Permits (MoM) |

7.5% |

3.0% |

-11.4% |

|

|

CAD |

Employment Change |

82.3K |

10.0K |

-2.8K |

|

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

CAD |

Unemployment Rate |

7.2% |

8.0% |

7.4% |

|

USD |

Continuing Jobless Claims |

3338K |

3350K |

3354K |

|

CAD |

Ivey PMI |

63.5 |

66.0 |

66.5 |

|

GBP |

NIESR GDP Estimate |

0.1% |

0.1% |

Economic Events scheduled for April 6, 2012 that affect the European and American Markets

13:30 USD Average Hourly Earnings (MoM)

13:30 USD Private Nonfarm Payrolls

Average Hourly Earnings measures the change in the price businesses pay for labor, not including the agricultural sector. Private Nonfarm Payrolls measures the change in the number of total number of paid U.S. workers of any business, excluding general government employees, private household employees, employees of nonprofit organizations that provide assistance to individuals and farm employees.

13:30 USD Nonfarm Payrolls

13:30 USD Unemployment Rate

Nonfarm Payrolls measures the change in the number of people employed during the previous month, excluding the farming industry. Job creation is the foremost indicator of consumer spending, which accounts for the majority of economic activity. The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month.

Government Bond Auctions

None scheduled until after April 10, 2012 due to holiday schedule

Originally posted here