GBP/USD Fundamental Analysis March 16, 2012, Forecast

Analysis and Recommendations:

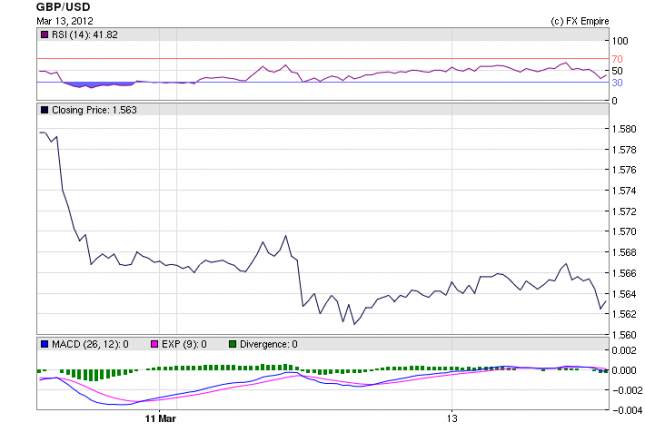

The GBP/USD is currently is up in today’s session trading at 1.5723 after opening at 1.5675.

Today, Fitch lowered its outlook for the United Kingdom, indicating a ratings downgrade may be coming.

The rating agency said that while the UK was well-positioned now, it had limited ability to absorb any further economic shocks from the European economic crisis.

Fitch affirmed its triple-A investment grade ratings for the UK’s issuer default and country ceiling ratings. But it lowered the UK’s rating outlook to negative from stable and said there was a more than 50 per cent chance of a downgrade over the next two years.

This is not necessarily negative report, as Fitch did affirm the current AAA rating and is only projecting negativity if this economic crisis continues over the next two years.

A long list of positive economic data from the US, had an opposite reaction on the USD, as investors decided to brave more risky assets and moved from the dollar to other currencies and commodities. The GBP benefited rising against the USD.

The number of Americans who filed requests for jobless benefits fell by 14,000 last week to 351,000, matching a four-year low, the U.S. Labor Department said Thursday. Claims from two weeks ago were revised up to 365,000 from 362,000.

The Empire State manufacturing index rose to 20.2 in March, the New York Federal Reserve Bank said Thursday. This is the fourth straight increase after the index had sunk below zero from June through October.

U.S. wholesale prices rose a seasonally adjusted 0.4% in February, the fastest increase in five months, sparked by higher petroleum costs, the Labor Department said Thursday.

Foreign investors were buyers in January of a net $94.7 billion of long-term U.S. securities, Treasury Department data released Thursday showed. This is much stronger than the revised $19.4 billion of net sales in December.

Manufacturing activity in the Philadelphia region edged higher in March to its highest reading since last April, the Philadelphia Federal Reserve reported Thursday. The bank’s business condition index rose to 12.5 in March from 10.2 in February

And finally RealtyTrac reported that foreclosure activity fell 8% nationally, compared with a year ago.

Released Economic Reports for March 15, 2012 actual v. forecast

|

Date |

Time |

Currency |

Event |

Actual |

Forecast |

Previous |

|

Mar. 15 |

09:30 |

CHF |

Interest Rate Decision |

0.00% |

0.00% |

0.00% |

|

10:00 |

EUR |

ECB Monthly Report |

||||

|

11:00 |

EUR |

Employment Change (QoQ) |

-0.2% |

-0.2% |

-0.2% |

|

|

13:30 |

USD |

Core PPI (MoM) |

0.2% |

0.2% |

0.4% |

|

|

13:30 |

USD |

PPI (MoM) |

0.4% |

0.5% |

0.1% |

|

|

13:30 |

USD |

Initial Jobless Claims |

351K |

356K |

365K |

|

|

13:30 |

USD |

NY Empire State Manufacturing Index |

20.2 |

17.4 |

19.5 |

|

|

13:30 |

USD |

Continuing Jobless Claims |

3343K |

3405K |

3424K |

|

|

14:00 |

USD |

TIC Net Long-Term Transactions |

101.0B |

29.3B |

19.1B |

|

|

15:00 |

USD |

Philadelphia Fed Manufacturing Index |

12.5 |

11.4 |

10.2 |

Economic Events for March 16, 2012

Time Currency Event Forecast Previous

13:30 CAD Foreign Securities Purchases 6.27B 7.38B

Foreign Securities Purchases measures the overall value of domestic stocks, bonds, and money-market assets purchased by foreign investors.

13:30 CAD Manufacturing Sales (MoM) 0.60% 0.60%

Manufacturing Sales measures the change in the overall value of sales made at the manufacturing level.

13:30 USD Core CPI (MoM) 0.2% 0.2%

13:30 USD CPI (MoM) 0.4% 0.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

14:15 USD Industrial Production (MoM) 0.4% 0.0%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

14:55 USD Michigan Consumer Sentiment Index 75.7 75.3

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

Government Bond Auction Schedule (this week)

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here