By FXEmpire.com

GBP/USD Fundamental Analysis March 21, 2012, Forecast

Analysis and Recommendations:

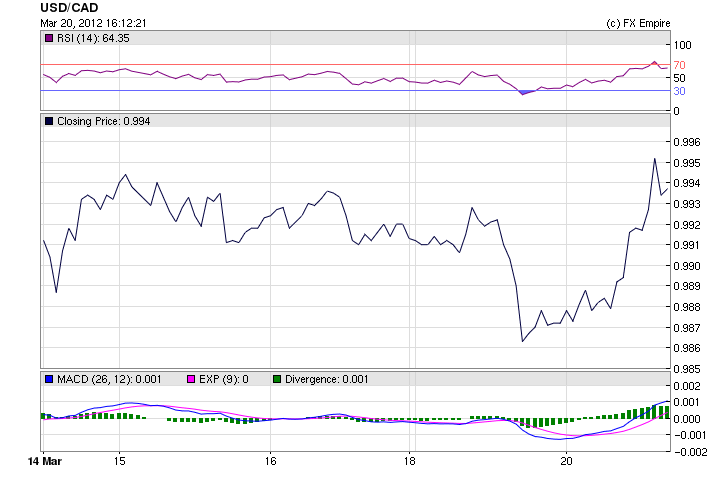

The GBP/USD is currently down for the day. The pound moved up in early European trading, hitting a high of 1.5900 as several economic reports were released in the UK. Core CPI and CPI matched forecasts, but Industrial Trends Orders came in well under forecast.

Britain’s Office for Budget Responsibility will revise its economic forecast slightly higher when the U.K. government presents its budget this week, the Financial Times reported.

Annual consumer price inflation in Britain slowed to 3.4% in February, slowing from a 3.6% annual pace in January, the Office for National Statistics reported. On a monthly basis, consumer inflation rose 0.6% from January.

As the day moved on, worries about Chinese economic slowdown seemed to prevail throughout the markets, although the data was released over the past weeks, and the Chinese Premier has mentioned it several times in speeches recently, it seemed that the overall effects have reached the markets.

The USD seemed to regain strength, and pushed the GBP down to 1.5868 to end the day.

Economic Releases March 20, 2012 Asia, Europe and the US

|

Mar. 20 |

00:00 |

AUD |

CB Leading Index (MoM) |

1.1% |

-0.3% |

|

08:00 |

EUR |

German PPI (MoM) |

0.4% |

0.5% |

0.6% |

|

09:15 |

CHF |

Industrial Production (QoQ) |

7.9% |

0.4% |

-2.0% |

|

10:30 |

GBP |

Core CPI (YoY) |

2.4% |

2.4% |

2.6% |

|

10:30 |

GBP |

CPI (YoY) |

3.4% |

3.4% |

3.6% |

|

10:30 |

GBP |

RPI (YoY) |

3.7% |

3.4% |

3.9% |

|

12:00 |

GBP |

CBI Industrial Trends Orders |

-8 |

-5 |

-3 |

|

12:30 |

EUR |

Spanish Trade Balance |

-3.65B |

-4.50B |

-4.50B |

|

13:30 |

USD |

Building Permits |

0.72M |

0.69M |

0.68M |

|

13:30 |

USD |

Housing Starts |

0.70M |

0.70M |

0.71M |

|

14:00 |

RUB |

Russian Retail Sales (YoY) |

7.7% |

7.3% |

6.8% |

|

14:00 |

RUB |

Russian Unemployment Rate |

6.5% |

6.7% |

6.6% |

|

16:30 |

USD |

4-Week Bill Auction |

0.100% |

0.070% |

10:30 GBP MPC Meeting Minutes

The Monetary Policy Meeting Minutes are a detailed record of the Bank of England’s policy setting meeting, containing in-depth insights into the economic conditions that influenced the decision on where to set interest rates. The breakdown of the MPC members’ interest rate votes tends to be the most important part of the minutes.

13:30 CAD Leading Indicators (MoM)

The Leading Indicators Index is a composite index based on 10 economic indicators, that is designed to predict the future direction of the economy. The report tends to have a limited impact because most of the indicators used in the calculation are released previously.

15:00 USD Existing Home Sales

Existing Home Sales measures the change in the annualized number of existing residential buildings that were sold during the previous month. This report helps to gauge the strength of the U.S. housing market and is a key indicator of overall economic strength.

Government Bond Auctions (this week)

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here