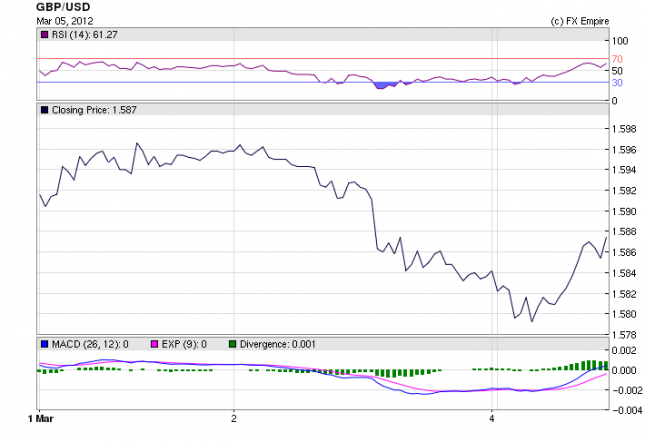

GBP/USD Fundamental Analysis March 6, 2012, Forecast

Analysis and Recommendations:

The GBP/USD is currently holding at 1.5860 benefiting from the weakness in the USD. The Sterling hit a high today of 1.5877. There were two economic releases in the UK today that took the shine off the Sterling allowing the greenback to recapture a bit.

UK services sector saw growth slow in February after the surge in January, the CIPS/Markit index shows.

Business expectations rose to their highest level for a year while output charges declined. Markit said sales were supported by discounting, with margins squeezed as input cost continued to rise.

Monday March 5, 2012 Economic Data Release actual v. forecast

|

AUD |

Company Gross Operating Profits (QoQ) |

5% |

0.3% |

4.7% |

|

CHF |

Retail Sales (YoY) |

4.4% |

2.0% |

1.7% |

|

GBP |

Services PMI |

53.8 |

55.0 |

56.0 |

|

EUR |

Retail Sales (MoM) |

0.3% |

-0.1% |

-0.5% |

Also today

In the US

The Institute of Supply Management said its non-manufacturing PMI climbed to 57.3 in February from a reading of 56.8 the previous month. Economists had expected the index to decline to 56.1.

Another report showed that U.S. factory orders fell, but at a slower than forecast rate in January, declining by a seasonally adjusted 1.0%, compared to forecasts for a 1.3% slide.

In Europe

Euro zone final composite PMI falls to final 49.3 in February

Italy services PMI 44.1 in February. Down from 44.8 in January and well below Reuter’s median forecast of 45.2.

Swiss January retail sales up +4.4% y/y.

Spanish services PMI 41.9 in February. Demonstrably lower than 46.1 in January and Reuter’s median forecast of 45.9.Eighth month of contraction, lowest read since November.

Economic Events: (GMT)

Tuesday will be a very quiet day on the Economic Data Front. With little was due on Monday and virtually nothing on Tuesday. Keep an eye on Australia, where the RBA will be announcing rates.

10:00 EUR GDP (QoQ) -0.3% -0.3%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

A higher than expected reading should be taken as positive/bullish for the EUR, while a lower than expected reading should be taken as negative/bearish for the EUR.

15:00 CAD Ivey PMI 62.1 64.1

The Ivey Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in Canada. A reading above 50 indicates expansion; a reading below 50 indicates contraction. The index is a joint project of the Purchasing Management Association of Canada and the Richard Ivey School of Business. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

A higher than expected reading should be taken as positive/bullish for the CAD, while a lower than expected reading should be taken as negative/bearish for the CAD.

Originally posted here