By FXEmpire.com

GBP/USD Monthly Fundamental Forecast April 2012

Outlook and Recommendation

The economic outlook for the UK has brightened over the last few months. In light of better-than expected results from the PMI surveys (particularly the services index),

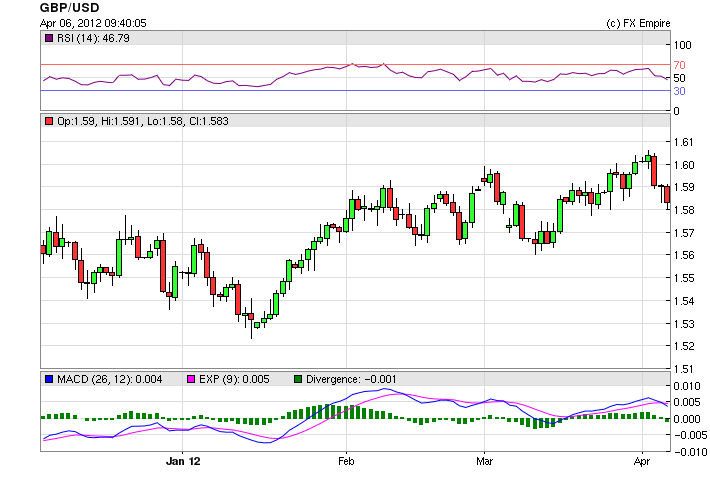

The GBP/USD has remained range-bound in March from 1.5603 to 1.6037. Though it was difficult for the Sterling to maintain the 1.60 price.

The dominant factor driving the North American currency forecast is the outlook for the US economy (and employment) in addition to oil prices, central bank policy and shifts at the long end of the US Treasury yield curve. The US dollar (USD) is supported by an improving economic backdrop, flows into US securities markets and a weakening outlook for both the yen and euro; however, US central bank policy and elevated oil prices are significant weights against the USD.

Investors are bearish, the Bank of England is dovish but technical’s are bullish, the government is committed to austerity and inflationary pressures are not dropping as quickly as the market had hoped. As we enter April, GBP has outperformed the USD, EUR and CAD on a year-to-date basis. A theme we expect to continue in Q2; accordingly we hold a year-end 1.63 target.

The UK’s medium-term growth prospects continue to compare favorably with those of its continental counterparts. The manufacturing PMI posted an unexpected gain in March, rising to 52.1, while the same indicator for the euro zone indicated a continued contraction in activity, with France and Germany falling back below the neutral 50-mark. Nevertheless, the economic situation is tenuous. Fourth-quarter GDP growth was revised lower in the final print (on a retrenchment in services), meaning that the economy grew only 0.7% in 2011 (the previous estimate was 0.8%). Inflation, at 3.4% y/y in February, has proved to be stickier than anticipated, and will likely average well above the Bank of England’s (BoE) 2% target this year. Recent official rhetoric suggests that additional quantitative easing is unlikely (notwithstanding two dissenters favoring expanded asset purchases at the last BoE meeting), though this will depend on key economic data over the coming months.

Central Bank

The Bank of England -BOE INTEREST RATE DECISION

Actual: 0.5%Cons.: 0.5%Previous: 0.5%

BoE Interest Rate Decision is announced by the Bank of England. If the BoE is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the GBP. Likewise, if the BoE has a dovish view on the UK economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

FED INTEREST RATE DECISION

Previous: 0.25%

The Board of Governors of the Federal Reserve announces an interest rate. This interest rate affects the whole range of interest rates set by commercial banks, building societies and other institutions for their own savers and borrowers. It also tends to affect the exchange rate. Generally speaking, if the Fed is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the USD.

Originally posted here