Do 18M unemployed people care what our GDP is?

Do 18M unemployed people care what our GDP is?

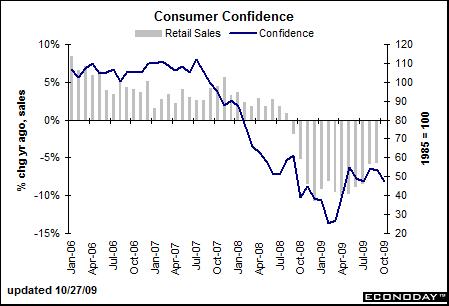

That’s the question the market will try to answer today as we get a measure of another 500,000 pink slips handed out last week. Hopefully, by the end of the month, a net 450,000 of those people will find new jobs but what is the cumulative effect? The bottom line is that, in the past 52 weeks, 25M people have lost their jobs and 20M of those people have gotten a job back or quit the workforce (which is just as “good” as measured by government statistics), which still leaves just under 6M people “officially” unemployed. With 10% unemployment and the average person knowing 144 people, that means we have a population where each person knows about 14 unemployed people and, obviously, that is not good for consumer confidence.

Things that are not good forr consumer confidence are not good for retail sales BUT today we will be looking at a very positive slice of the year in Q3, when we had Cash for Clunkers and we had housing stimulus and the stock market rose 20% while the dollar fell 7% and the Fed gave free money to the banks and IBanks, which drove many of them to record profits. Our corporations are reporting a Q3 that is much improved over Q2 because global stimulus is pumping money in and, thanks to the plunging dollar, they are paying the American workers they have left 15% less than they did last fall. That’s right suckers – you accept pay in dollars and you are not even smart enough to do what Europeans learned to do long ago – ask for currency-adjusted wages!

The farce in this earnings quarter is you have S&P 500 companies who collect 50% of their revenues overseas paying their American laborers in crappy US dollars. PRESTO – instand 15% “efficiency” savings on real labor costs. Companies have cut back on most capital sprending so when you see companies telling you how well their cost-cutting program is going, keep in mind that they laid off 10% of their workers and are paying the remaining 90% just 85% of what they were getting last year when measured in any major currency on the planet except the Dollar and the Yuan.

The farce in this earnings quarter is you have S&P 500 companies who collect 50% of their revenues overseas paying their American laborers in crappy US dollars. PRESTO – instand 15% “efficiency” savings on real labor costs. Companies have cut back on most capital sprending so when you see companies telling you how well their cost-cutting program is going, keep in mind that they laid off 10% of their workers and are paying the remaining 90% just 85% of what they were getting last year when measured in any major currency on the planet except the Dollar and the Yuan.

What will happen when/if dollar get expensive again? Most companies have already stripped fixed costs to the bone. If they are forced to come up with 15% more…