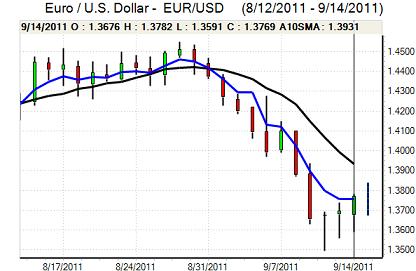

EUR/USD

The Euro found support on dips to the 1.36 area during Wednesday and secured a generally stronger tone as the correction from sharp losses continued. There were further tensions surrounding the Euro during the day as the debate surrounding Greece and the wider Euro-zone sovereign-debt crisis continued.

The German and French governments pledged their support for Greece in a conference call, although there were no fresh measures announced. There were also setbacks surrounding the EFSF vote as the Austrian parliament blocked any fast-track vote to expand the European support fund. Underlying confidence remained extremely fragile given expectations that Greece would eventually default and there were further political fissures within Germany.

The EU Commission stated that it would make additional proposals to strengthen the Euro-zone including the creation of Eurobonds, although political resistance to such plans will be high.

There were further fears surrounding the Euro-zone financial sector as there were credit-rating downgrades for two French banks while two banks also accessed the emergency ECB dollar funding facility. There was a further increase in dollar Libor rates as tensions remained high. There were further rumours surrounding a credit-rating downgrade for Italy and caution ahead of the Thursday Spanish debt auction.

The US retail sales data was slightly weaker than expected with no change for August while there was an underlying 0.1% increase for the month. The immediate data impact was limited with markets still focussed firmly on the Euro area. There were further expectations surrounding a relaxation of ECB monetary policy and yield spreads over the dollar narrowed to eight-month lows which continued to sap underlying Euro support.

The Euro continued to consolidate in Asian trading on Thursday with further resistance close to the 1.3750 area and a retreat back towards the 1.37 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any headway against the yen on Wednesday and dipped to lows near 76.60 with little sign of a rebound. The US economic data failed to provide any yield support for the US currency with no growth for retail sales.

Underlying confidence in the global economy remained fragile and there was some evidence of a flow of funds out of Asian currencies which provided some degree of support for the Japanese currency.

There were also fears surrounding the Euro-zone economy and the potential for capital repatriation from the Euro-zone as Euro fears persisted. There was no significant support for the dollar in Asian trading on Thursday. Markets inevitably remained on high alert over the risk of Bank of Japan intervention which had some impact in restraining the yen.

Sterling

Sterling found support in the 1.57 area against the dollar on Wednesday and rallied during the European session with a peak just above 1.58, but there was no sustained buying support.

The headline UK unemployment claimant count was slightly better than expected with an increase of 20,300 for August after a revised 33,700 increase the previous month. In contrast, the 3-month unemployment figures were weaker than expected with the biggest quarterly increase for over two years as government employment fell sharply.

Underlying confidence in the economy remained extremely fragile amid fears that there would be a further deterioration in consumer confidence while there was important unease surrounding the banking sector and Sterling drifted back to the 1.5750 area.

Swiss franc

The dollar was unable to break above 0.8850 against the franc on Wednesday and retreated to lows below 0.8750 before rallying back towards the 0.88 area. The Euro found support on dips towards 1.2020 and rallied back to 1.2060 with relief that tensions within the Euro area had not escalated further.

There was also an unwillingness to take on the National Bank’s 1.20 minimum level against the Euro, especially with the central bank holding its quarterly policy meeting on Thursday. There was speculation that additional measures could be taken to push the franc even weaker at the meeting. There will still be the potential for capital flows into Swiss banks as fears surrounding the Euro-zone financial sector continue to increase and volatility is liable to spike higher again.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

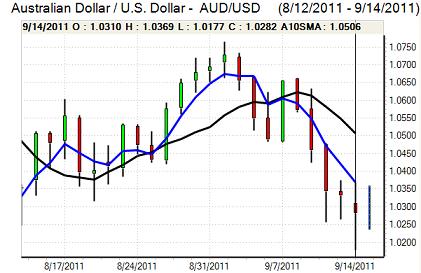

Australian dollar

The Australian dollar found support below 1.02 against the US currency on Wednesday and rallied back to the 1.0280 area as it corrected over-sold conditions, but it was unable to sustain the gains.

There was further speculation over a shift in Reserve Bank policies to a more accommodative stance following the downward revision to inflation estimates and fears over the economy with a particular focus on the housing sector.

Risk appetite also remained extremely fragile as confidence in the global economy deteriorated and sustained capital flows out of Asian currencies would have an important negative impact on Australian dollar sentiment. The currency re-tested support below 1.02 late in the Asian session.