EUR/USD

The Euro maintained a firm tone in European trading on Monday as risk appetite also continued to recover with equity markets rebounding from two weeks of consecutive daily declines.

There was further speculation of an IMF-backed loan package for Italy and there were additional reports that Germany and France would move to issue elite bonds among the AAA countries and accelerate fiscal integration. Both the IMF and German government denied that talks had taken place or that any move to issue bonds was being contemplated.

There was some positive news from the economic data as German consumer confidence rose for December, but money supply growth was weaker than expected and underlying stresses within the banking sector remained extremely high.

The latest Euro-zone bond auctions were slightly better than expected which eased market tensions slightly, although underlying confidence remained extremely fragile with bigger tests of investor demand due on Tuesday. The Euro pushed to highs near 1.34 against the dollar before weakening again during the New York session as sentiment deteriorated again.

There was a warning from ratings agency Moody’s over the probability of a downgrading of European bank ratings and there were also additional rumours that France’s credit rating would be downgraded within the next few days. The Euro-group meeting on Tuesday and wider ECOFIN meeting on Wednesday will be watched extremely carefully for evidence of fresh initiatives or signs that Germany is reconciled to a path which leads towards the break-up of the Euro.

A slightly weaker than expected US housing report had no significant impact on the markets. Fitch maintained its AAA rating for the US, but did lower the outlook to negative from stable which reminded markets over the very fragile US deficit situation. The net outcome was a Euro retreat back to the 1.33 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen maintained a weaker tone during Monday and dipped to lows around 78.20 against the dollar as the Japanese currency also lost ground on the major crosses with players looking to squeeze out long yen positions.

There was no direct evidence of intervention pushing the currency weaker with the yen also undermined by a general improvement in risk appetite while there was also some further evidence of long-term selling on valuation grounds.

The Japanese economic data was mixed with a slightly stronger than expected reading for retail sales while the unemployment rate rose sharply to 4.5% from 4.1% previously. For now, trends in risk appetite are likely to remain the dominant influence.

Sterling

Sterling pushed to a high near 1.56 against the dollar on Monday, primarily reflecting wider US losses with the UK currency unable to make any headway on the crosses as the Euro held around the 0.86 area.

The UK economic data was weaker than expected as the CBI retail sales survey weakened to the lowest level since the first quarter of 2009 at -19 for November from -11 previously with retailers downbeat over the outlook, reinforcing fears over the consumer spending outlook.

Bank of England Governor King stated that the UK was increasingly threatened by the Euro-zone outlook and the overall comments from bank officials suggested that further quantitative easing will be considered next year, although the outlook remained highly uncertain.

The UK government will announce plans for additional infrastructure spending in Tuesday’s Autumn Statement while growth forecasts will inevitably be downgraded. The extent of defensive support for UK bonds and discussion surrounding the AAA rating will continue to be an extremely important Sterling influence, especially with UK yields now at historic lows and Sterling retreated abck towards 1.55.

Swiss franc

The dollar dipped sharply against the franc during the European session on Monday with lows below the 0.92 level while the Euro also retreated back to below 1.23 in choppy trading conditions.

National Bank Chairman Hildebrand stated that the franc was still very highly valued at current levels and that he expected the currency to weaken further in the medium term. These comments and an inevitable fear surrounding the threat of intervention curbed any further buying support for the franc with the dollar regaining the 0.92 level. There will be the risk of further volatile trading, especially given major fears surrounding the European banking sector.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

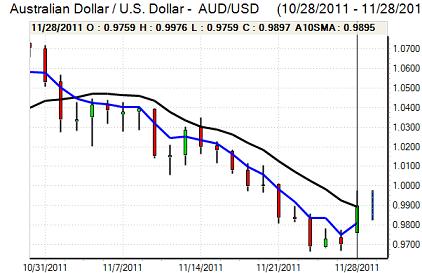

Australian dollar

The Australian dollar continued to rebound strongly during Monday, in line with a general improvement in risk appetite, and it peaked just below parity against the US dollar. It was unable to sustain the advance and weakened back to the 0.99 area in Asia on Tuesday.

There was still a high degree of concern over the outlook for the global economy and banking sector, especially after the OECD warnings and this continued to restrain underlying buying support for the currency.

The domestic influences remained limited as attention remained firmly on the international environment.