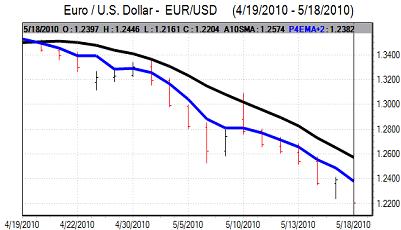

EUR/USD

After faltering again in Asian trading on Tuesday, the Euro was able to make some headway in early Europe with a tentative probe of resistance levels above the 1.24 area. The German ZEW index fell to 45.8 for May from 53.0 which was slightly weaker than expected as European debt fears undermined business confidence.

The survey evidence reinforced fears over the Euro-zone growth outlook and maintained market unease that planned fiscal tightening would further damage 2010 prospects.

The US housing starts data was close to expectations with a rise to 0.67mn for April from a revised 0.64mn the previous month. There was, however, a sharp decline in permits to an annual rate of 0.61mn from 0.69mn previously which will maintain some doubts over the sustainability of the current rebound and there was some deterioration in risk appetite following the data.

The Euro was unable to make any further headway and was then subjected to renewed heavy selling pressure later in the US session. A decline on Wall Street helped trigger some fresh defensive demand for the dollar and there was also an exodus from the Euro as the German government proposed a ban on short selling in the major German financial companies.

The Euro crashed through support levels and weakened to a fresh 4-year low below 1.22 before attempting to stabilise.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The domestic Japanese data was weaker than expected with a smaller than expected improvement in consumer confidence while there was also a sharp decline in the index of tertiary activity. Finance Minister Kan was generally downbeat over the economic situation and stated that further government spending may be required to support the economy. In this environment, there will be pressure for yen gains to be resisted.

Risk appetite was generally fragile during Tuesday and this continued to provide background support for the yen with the dollar unable to make any significant headway as carry-trade activity remained more limited.

The dollar was unable to break above the 93 level and then weakened back to the 92 area during US trading as risk appetite deteriorated while the Euro weakened to near the 112 level.

Sterling

The UK currency initially edged weaker again in Asian trading on Tuesday before recovering ground. The consumer inflation rate rose to 3.7% for April from 3.4% while the RPI rate rose sharply to 5.3%. as the inflation rate was pushed up by higher taxes and energy costs.

The Bank of England Governor was forced to write a letter to the Chancellor explaining why the inflation rate was more than 1.0% above the 2.0% target rate. In the letter, King stated that the inflation rise should be short-lived and that the bank could act to tighten or loosen policy as required, while the overall impression was that the bank would err on the dovish side over the next few months.

Sterling will struggle to gain any sustained support given pressure on the Bank of England to keep interest rates at very low levels to compensate for aggressive fiscal tightening.

Sterling was resilient against the Euro, but it dipped to lows near 1.43 against the dollar due to widespread US currency gains.

Swiss franc

The dollar found support below 1.13 against the Swiss franc on Tuesday and pushed to fresh 12-month highs above 1.15 in US trading as the dollar gained safe-haven support. The Euro was subjected to wider selling pressure and this left it trapped close to 1.40 against the Swiss currency.

The Euro’s trading pattern close to the 1.40 level will reinforce speculation that it is only holding this level due to sustained National Bank intervention to sell francs.

The franc will continue to gain defensive support from a lack of confidence in the wider Euro-zone, especially if global risk appetite deteriorates further.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

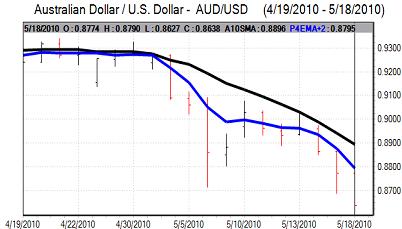

Australian dollar

The Reserve Bank minutes suggested that there would be a pause in interest rate increases which will tend to sap currency support. Risk appetite is also likely to remain generally weaker which will undermine confidence in carry trades and curb currency support.

The Australian dollar was blocked below the 0.88 level against the US dollar and weakened sharply to lows near 0.8625 in New York trading as equity markets were subjected to renewed selling pressure.