It’s been a challenging few weeks for commodities traders. There has been a flight to the U.S. dollar, which has caused corrections in many commodities, particularly gold. The Canadian dollar has been pressing lower and futures broke support at 94c last week. However, I think there are reasons to be bullish both markets, if you step back and take a look at the big picture.

Gold

This market has seen a good correction this month, and March futures broke support near $1,080 an ounce. Looking at a longer-term trend, I wouldn’t get terribly discouraged by the correction. I think gold’s bullish trend is still intact. Investors have started abandoning their positions, and gold’s record above $1,200 an ounce in December 2009 now seems far away. I think the market just needed time to digest the rally, which came very quickly. As traders start to give up on the market, to me it is a classic sign that the decline has run its course. Savvy investors may want to start accumulating new positions and remember the long-term fundamentals.

Traders seem to have forgotten China and India both expressed interested in buying gold in large quantities. The IMF’s sale of 200 metric tons of gold to India last year seems like a lot, but is small relative to the amount of reserves for a country like India. It takes a lot to make a substantial impact. If global central banks are concerned about the U.S. dollar, they can accumulate a huge amount of the available global gold supply in a very short time.

In sum, I think there’s still a strong case to be bullish gold, and would recommend buying on dips. From a technical perspective, $1,050 looks like a good support point and a place to look to build positions.

Canadian Dollar

The Canadian dollar has also struggled in the past few weeks, and 93c has been a good support level in the futures. Many traders consider the Canadian dollar as a commodity based currency—and it is. Canada is rich in natural resources, which drive exports. However, when we compare the price of the Canadian dollar today relative to the past, it seems a bit undervalued. The last time it broke par, crude oil was at $95 a barrel, gold was at $800 an ounce, copper was trading at $290 per pound, and wheat was trading at $9.50 a bushel. While crude oil and wheat were higher then, but gold was far below where it is now, and copper was pretty close to where it is today. So in many ways, the linkage between the Canadian dollar and commodities doesn’t always hold over the long term. The currency is actually very far below where one might expect.

U.S. Dollar Crisis of Confidence Possible

The other part of the picture is the financial crisis of 2008, which demonstrated that traders seem to instinctively move into U.S. cash during times of crisis. That causes nearly every commodity priced in U.S. dollars to decline, and the Canadian dollar to decline. We saw that happening again in the past two weeks amid potential default in Greek sovereign debt and potential instability in the Eurozone. In many ways, it’s an irrational market reaction because the Canadian dollar is actually a stronger currency to hold than the U.S. dollar in terms of having a solid economic base behind it.

Over time, I expect there may be a crisis of confidence in the U.S. currency. This deleveraging that’s occurred as investors moved into the U.S. dollar may move into alternative currencies, including Canada’s. Russia has stated recently they would move some reserves into Canadian dollars and out of the U.S., and other countries may follow suit. The Canadian dollar has a smaller market capitalization, so for a country to allocate more money toward Canada, we would see a larger move in the market.

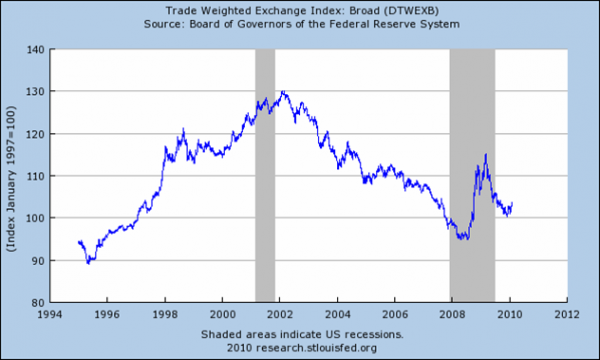

Trade-Weighted U.S. Dollar

The U.S. dollar still has a long way to decline on an historical basis if we do get into a crisis of confidence in the U.S. The U.S. dollar is stronger than it was even in the 1990s a good time for the economy. Through the financial crisis, the dollar increased dramatically and then fell off. I think there are a number of reasons a crisis of confidence could take place in the U.S. economy that would renew the commodity rally and the Canadian dollar.

There are four serious issues in the U.S. that would cause this to happen: growth in the monetary base though printing of money, fiscal deficit, trade deficit, and the Social Security and Medicare deficit. The U.S. government and Federal Reserve have been good at calming the market and distracting participants from these issues, but they could become a crisis if the investing public starts to react out of fear. The mathematics of the situation are pretty dire.

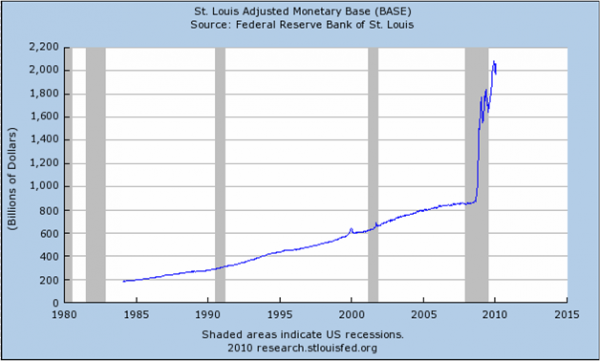

A chart of the monetary base shows that in other recessions, we haven’t seen as nearly a large increase in the money supply as we have today. The crisis surrounding hedge fund Long-Term Capital Management and the Tech Wreck in the 1990s and 2000 didn’t result in the same increase in the monetary base that we have currently.

The reaction during this crisis has been abnormal, or unique, compared to other crisis periods. Money is like a countries shares, or units of ownership. You basically take the total amount out there, and divide the total wealth by that number to think about how a currency is valued.

Printing more currency is like printing more shares of the U.S., and each share is worth less than it was before. That has implications for investor portfolios, property values and debt people owe.

The other big part of the story is the U.S. trade deficit, which has been negative since the 1970s. To have a negative balance of payments (negative trade balance), a country needs to be attracting investment. It may be in the form of foreign corporations buying assets in the U.S. or investors buying Treasury bonds or Treasury bills. Wealth has to come in from outside the country.

A trade deficit can be in place for decades, but eventually it has to be turned around. That may be through economic struggle (recession), which forces reduction in consumption, and lowers imports. The natural forces of economics come into play to narrow the deficit, which we saw in 2009. The trade deficit has been a serious issue for some time and I think it will remain problematic.

In addition, we all know that President Obama recently announced the U.S. fiscal deficit would be $1.6 trillion, and the outlook for balancing the deficit anytime soon is unlikely. Therefore, the government must continue to borrow funds and essentially increase interest rates at the long end of the yield curve.

There are serious risks to the U.S. economy. I don’t think it’s time to turn bearish on commodities, or on the Canadian dollar.

Aaron Fennell is a Senior Market Strategist based in Lind-Waldock’s Toronto office, and is serving clients in Canada. If you would like to learn more about futures trading you can contact him at 877-840-5333, or via email at afennell@lind-waldock.com.

The data and comments provided above are for information purposes only and must not be construed as an indication or guarantee of any kind of what the future performance of the concerned markets will be. While the information in this publication cannot be guaranteed, it was obtained from sources believed to be reliable. Futures and Forex trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Please carefully consider your financial condition prior to making any investments. Not to be construed as solicitation.

(c) 2010 MF Global Holdings Ltd. Lind-Waldock , a division of MF Global Canada Co. MF Global Canada Co. is a member of the Canadian Investor Protection Fund.

Futures Brokers, Commodity Brokers and Online Futures Trading. 123 Front St. West, Suite 1601, Toronto, ON M5J2M2. Toll-free 877-501-5463.