By FXEmpire.com

The gold markets fell again during the Thursday session as the fears of a global slowdown put a bid in for the safety trade in general. Because of this, the Dollar got a nice bid for most of the session, and this in turn had gold markets falling as the commodity is priced in those very same US dollars.

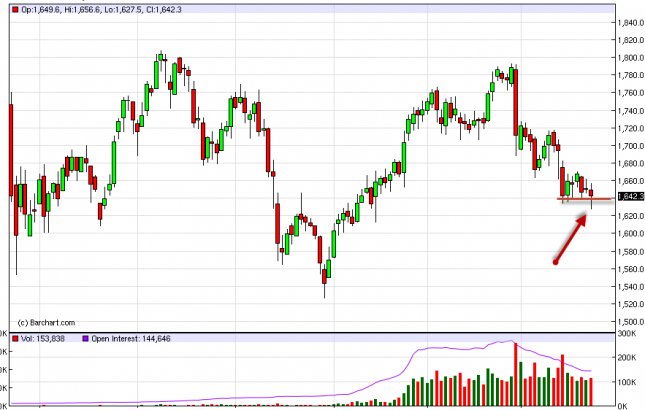

The end of the day did see a bounce though, and the formation is a hammer at the close. The buyers simply came in and gave the market the support it needed. After all, the central banks around the world are still printing money, or easing in other ways, so it makes sense that people would prefer gold over a fiat currency at this point in time.

The hammer was formed right on a support level that we have been watching for the last week, and it shows just how strong the $1,640 level is becoming for the bulls. While we haven’t seen a significant bounce from this level yet, we did see serious support on Thursday, and this suggests that the bounce might be coming soon. In fact, the hammer is one of the best signals that we follow. It should also be noted that we are at roughly the 50% Fibonacci retracement level currently, and this will of course attract a certain amount of traders who missed the massive move at the start of the year.

We still see this market as a “buy only” one, and will only do so. A break of the top of the Thursday range is our signal to go long, understanding that the market may grind a bit instead of spiking like we would prefer. The resistance comes into play at roughly $1,675 and $1,700 above, but in the big scheme of things, we don’t suspect they are major resistance. The last eleven years have all been bullish for gold, and as a result we want to be long of it whenever it makes sense. Selling isn’t possible until we are well below the $1,500 level.

Gold Forecast March 23, 2012, Technical Analysis

Originally posted here