By FXEmpire.com

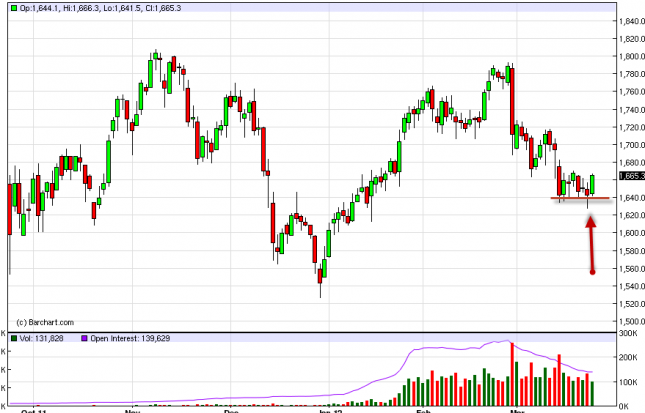

The gold market rose during the Friday session to trigger our buy signal that was placed after the Thursday hammer. The $1,640 level looks as if it has held as support, and as a result we feel that the new long position we have initiated is the correct way to go at the moment.

The market looks as if there is a fair bit of resistance going forward, but the truth is that the trend is up, and the reasons to buy gold are numerous. The central banks of the world are easing, and this will almost always send at least some traders into this market. The fact that the ECB, Fed, and BoE all look ready to crank up the easing if needed suggests that perhaps sooner or later gold will have to be bought. Also, we shouldn’t forget that the central banks are net buyers of gold as well, and this means massive buying.

The markets have been a bit skittish lately, and the gold markets wouldn’t be a big surprise to act in a similar manner. However, as we have seen over the last 11 years, anytime this market falls like this, new strength comes back into the fold.

The $1,700 level is more than likely the next target. The level will be resistive obviously, but the market has been quite a bit higher than that level, so the bulls won’t be spooked by it, but a reaction could occur. If we weren’t already involved, we would be buying dips going forward until the $1,700 barrier is broken through.

The $1,640 area still remains as our support, and we feel that it should hold in the near term. As far as larger support levels, we can find none bigger than the $1,500 level, which for our money is a “line in the sand” where we won’t buy if we get below. Until then, we can only be long or flat of this market. The selling of it isn’t possible until we break down like mentioned, and going forward we can buy dips as the market looks to gain.

Gold Forecast March 26, 2012, Technical Analysis

Originally posted here