By FXEmpire.com

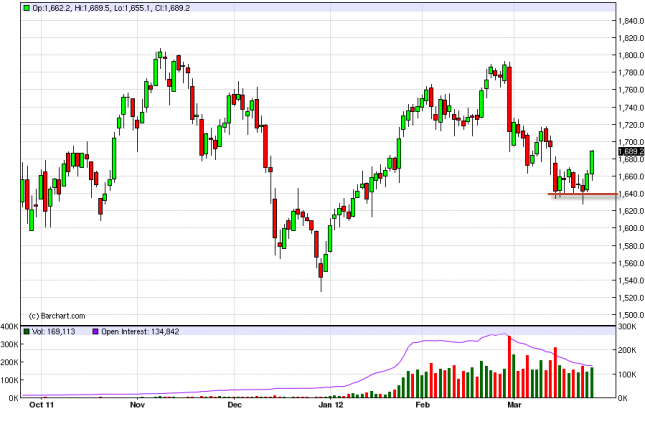

The gold markets have been falling quite a bit over the last several weeks, but the Monday session saw much of that bearishness completely vanish in a few short moments. The Federal Reserve Chairman Ben Bernanke suggested during the session that the Fed cannot rule out “Quantitative Easing 3”, and as a result the idea of easy money pushed the risk trade much higher, and gold was certainly no different.

The risk on trade was already starting to pick up early in the session, but when faced with the possibility of a weaker Dollar, the gold bugs went wild. The $1,700 level was our previous target, and it looks as if the level will be tested in short order. The level will more than likely produce a bit of a fight, so any pullback from it should simply be a buying opportunity as the trend continues higher. In fact, the trend has been running for over 10 years now, so we are always skeptical of shorting the market.

The $1,640 level is obviously a massive support level at this point, as punctuated by the hammer on Thursday of last week. This is now the point that we expect the market to defend against the bears going forward. The $1,700 giving way to the upside on a daily close has us adding to our long positions as it shows an uptick in momentum by the buyers again.

The next target that we can see in this market to the upside is the $1,750 area, but we still like the idea of a run to the $1,800 level. In fact, we think the market goes all the way to the $2,000 level within twelve months. As the market likes to suddenly move $50 a day at times, this really isn’t that big of a stretch, even though it seems like it is much higher. The selling of this market cannot be done as the market has again shown far too much strength. The breaking of $1,700 on a daily close has us buying this market as we continue to add to our core positions.

Gold Forecast March 27, 2012, Technical Analysis

Originally posted here