By FXEmpire.com

Gold Fundamental Analysis April 18, 2012, Forecast

Analysis and Recommendations:

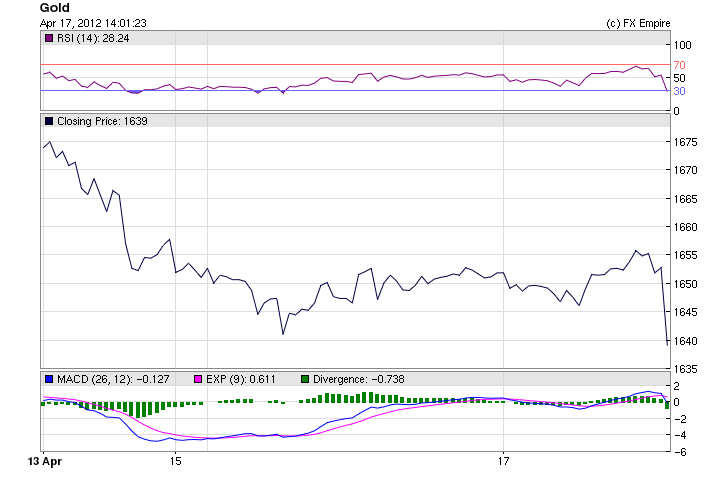

Gold has climbed today to 1653.45 moving up slightly by 3.45 as the USD dropped on negative home builder’s data and industrial production reports.

Industrial production was unchanged for the second month running in March, the Federal Reserve said Tuesday. Economists polled by MarketWatch had forecast a 0.3% gain. While utilities output gained 1.5%, manufacturing output slipped 0.2%

Although U.S. builders start work on new homes at a sharply slower March pace, construction permits jump to their highest level in 3 1/2 years, data showed. Builders began construction on new U.S. homes at a slower pace in March, but permits jumped to the highest level since September 2008, the Commerce Department reported Tuesday. Housing starts fell 5.8% last month to an annual rate of 654,000.

It closed at its lowest level in a week on Monday after investors sidestepped gold and instead sought out the U.S. dollar as a haven against euro-zone debt concerns.

Gold struggled for direction as investors weighed the news from Europe but sensed that concerns remained.

A successful bond auction in Spain and data showing German investor confidence rising for the fifth month in a row added to hopes the euro zone is on the mend.

Economic Reports April 17, 2012 actual v. forecast

|

Apr. 17 |

AUD |

Monetary Policy Meeting Minutes |

||

|

JPY |

Industrial Production (MoM) |

-1.6% |

-1.2% |

-1.2% |

|

INR |

Indian Interest Rate Decision |

8.00% |

8.30% |

8.50% |

|

GBP |

Core CPI (YoY) |

2.5% |

2.4% |

2.4% |

|

GBP |

CPI (YoY) |

3.5% |

3.5% |

3.4% |

|

GBP |

CPI (MoM) |

0.3% |

0.3% |

0.6% |

|

EUR |

CPI (YoY) |

2.7% |

2.6% |

2.6% |

|

EUR |

German ZEW Economic Sentiment |

23.4 |

20.0 |

22.3 |

|

EUR |

ZEW Economic Sentiment |

13.1 |

10.7 |

11.0 |

|

EUR |

Core CPI (YoY) |

1.6% |

1.5% |

|

|

USD |

Building Permits |

0.747M |

0.710M |

0.715M |

|

USD |

Housing Starts |

0.654M |

0.705M |

0.694M |

|

Manufacturing Sales (MoM) |

-0.30% |

-1.00% |

-1.30% |

|

|

EUR |

ECB President Draghi Speaks |

|||

|

CAD |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Originally posted here