By FXEmpire.com

Gold Fundamental Analysis April 23, 2012, Forecast

Analysis and Recommendations:

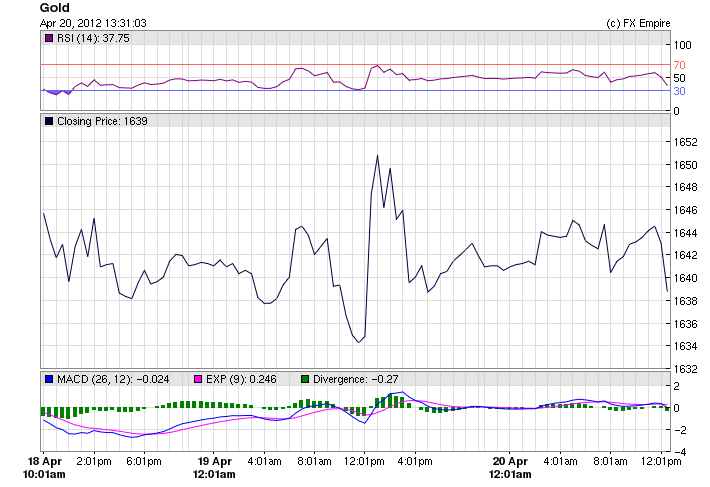

Gold rose as the dollar pared gains, boosting demand for the precious metal as an alternative asset. The greenback was little changed against a basket of major currencies after climbing as much as 0.4 percent. Christine Lagarde, the managing director of the International Monetary Fund, said at a press briefing in Washington that she expects the resources of the IMF to be “significantly increased” amid Europe’s sovereign-debt crisis. Gold futures for June delivery rose 0.1 percent to settle at $1,643.85 an ounce at 1:50 p.m. on the Comex in New York. Earlier, the price dropped as much as 0.5 percent. Silver futures for May delivery gained 0.9 percent to $31.639 an ounce on the Comex. On the New York Mercantile Exchange, platinum futures for July delivery slid 0.1 percent to $1,578 an ounce, and palladium futures for June delivery rose 0.9 percent to $663.30 an ounce.

Gold also reacted to the Munich-based Ifo Institute’s German business confidence index rose to 109.9 in April from a reading of 109.8 in March, data showed Friday. Economists had forecast a decline to 109.5.

Economic Data for April 20, 2012 actual v. forecast

|

JPY |

Tertiary Industry Activity Index (MoM) |

0.0% |

0.8% |

-0.6% |

|

AUD |

Import Price Index (QoQ) |

-1.2% |

-1.0% |

2.5% |

|

EUR |

German PPI (MoM) |

0.6% |

0.4% |

0.4% |

|

EUR |

German PPI (YoY) |

3.3% |

3.1% |

3.2% |

|

EUR |

German Ifo Business Climate Index |

109.9 |

109.5 |

109.8 |

|

EUR |

German Current Assessment |

117.5 |

117.0 |

117.4 |

|

EUR |

German Business Expectations |

102.7 |

102.5 |

102.7 |

|

GBP |

Retail Sales (MoM) |

1.8% |

0.5% |

-0.8% |

|

GBP |

Retail Sales (YoY) |

3.3% |

1.4% |

1.0% |

|

Core CPI (MoM) |

0.3% |

0.4% |

||

|

CAD |

CPI (MoM) |

0.4% |

1.0% |

0.4% |

|

CAD |

Leading Indicators (MoM) |

0.4% |

1.0% |

0.7% |

|

CAD |

CPI (YoY) |

1.9% |

2.0% |

2.6% |

|

MXN |

Mexican Unemployment Rate |

4.6% |

4.9% |

5.3% |

Economic Events scheduled for April 23, 2012 that affect the European and American Markets

06:00:00 GBP Nationwide Housing Prices n.s.a (YoY) -0.90%

The Nationwide Housing Prices shows the value of the houses prices in UK and indicate current movements in the housing market that is considered as a sensitive factor to the UK’s economy. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

06:00:00 GBP Nationwide Housing Prices s.a (MoM) -1%

The Nationwide Housing Prices shows the value of the houses prices in UK and indicate current movements in the housing market that is considered as a sensitive factor to the UK’s economy. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

07:28:00 EUR Purchasing Manager Index Manufacturing 48.4

The Manufacturing Purchasing Managers Index (PMI) released by the Markit economics captures business conditions in the manufacturing sector. As the manufacturing sector dominates a large part of total GDP, the manufacturing PMI is an important indicator of business conditions and the overall economic condition in Germany. Normally, a result above 50 signals is bullish for the EUR, whereas a result below 50 is seen as bearish.

07:28:00 EUR Purchasing Manager Index Services 52.1

The Services PMI released by the Markit Economics interviews German executives on the status of sales, employment, and their outlook. Because the performance of the German service sector is extremely consistent over time, services does not impact final GDP figures as much as the more volatile figure on the manufacturing sector. Any reading above 50 signals expansion, while a reading under 50 shows contraction.

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Click here for updated Gold News.

Originally posted here