By FXEmpire.com

Gold Fundamental Analysis April 4, 2012, Forecast

Analysis and Recommendations:

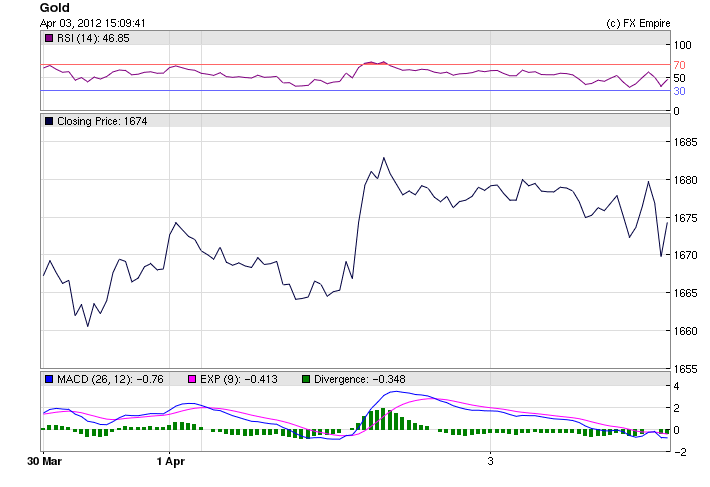

Gold dropped again today, before the FOMC minutes are released. Gold is trading at 1672.95 down 6.75 but still higher then forecast, falling alongside the broader commodities market after two sessions of gains.

“Gold has now found itself without sufficient investor appetite to gain upward momentum but also a soft floor in light of weak physical demand,” said analysts at Barclays.

“Demand from China has started to pick up but is only notably responsive to sharp price drops, while gold imports into Turkey have more than halved over the quarter,” they said.

The Federal Reserve’s policy setting committee is due to release their latest meeting minutes at 2 p.m. EDT. Gold traders will be scouring the documents for any clues about shifts in policy and hints about the committee’s stance of a third round of monetary stimulus, known as QE3.

“We could see the downward trend continue as participants grow anxious about the release of the FOMC minutes later today and what it might say or imply about the prospects for additional quantitative easing,” Marc Ground, a metals analyst with Standard Bank, said in a note. “We don’t feel that there will be any major changes to the current stance, however, we would not underestimate the market’s capacity to read between the lines, which could see some price reaction.”

Fed speeches have set the tone for the gold market over the past few months. Gold futures plunged more than $100 during Chairman Ben Bernanke’s speech on Feb. 29 which avoided any mention of QE3 and sparked worries the stimulus measure was off the table for good.

By contrast, a Bernanke speech on March 26 swept prices higher after he said the U.S. labor market recovery was fragile and that the bank’s accommodative policies must remain in place to support growth.

Gold prices benefit from monetary easing, which tends to erode the value of paper currencies, boosting demand for hard assets like gold.

Imports of gold by India, the world’s largest gold consumer, fell by over 55% in March, with jewelers shutting down their establishments across the country demanding a rollback of the duty hike proposed in the Union Budget.

“The country would have imported just 15 to 20 tonnes of gold in March as against 45 to 55 tonnes that is usually imported on a monthly basis,” said Prithviraj Kothari, president of the Bombay Bullion Association. He added that the high price of the precious metal also deterred fresh purchases.

Gold Bullion imports shrank to 90 tonnes in the January-March 2012 period, as against 283 tonnes in the corresponding quarter of last year. In January, 40 tonnes of gold was imported, while in February around 30 tonnes was imported. The jewelers’ strike and the import hike in March depressed demand further.

In January, the government hiked the gold import duty from 1% to 2%. Again in March, import duty was doubled to 4%. Speaking about the decline in imports, jewelers said high interest rates and inflation were also affecting consumption of the precious metals.

Puran Doshi of the Mumbai Wholesale Gold Jewellers Association said, “Though March is a lean period for the jewelry business, this year there were important festivals like Gudi Padwa and Ugadi. The spring festival too was celebrated in different parts of the country. These times are considered auspicious for purchasing gold, but due to the strike sales did not happen and jewelers have incurred a huge loss.

There are rumors today that the strike action might be concluding which would put an immediate demand on gold.

Economic Events April 3, 2012 actual v. forecast

|

JPY |

Monetary Base (YoY) |

-0.2% |

12.6% |

11.3% |

|

JPY |

Average Cash Earnings (YoY) |

0.7% |

0.2% |

-0.9% |

|

AUD |

Retail Sales (MoM) |

0.2% |

0.3% |

0.3% |

|

AUD |

Interest Rate Decision |

4.25% |

4.25% |

4.25% |

|

AUD |

RBA Rate Statement |

|||

|

TRY |

Turkish CPI (MoM) |

0.41% |

0.59% |

0.56% |

|

TRY |

Turkish PPI (MoM) |

0.36% |

0.74% |

-0.09% |

|

GBP |

Construction PMI |

56.7 |

53.5 |

54.3 |

|

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

|

EUR |

PPI (MoM) |

0.6% |

0.5% |

0.8% |

|

GBP |

10-Year Treasury Gilt Auction |

2.22% |

2.18% |

|

|

BRL |

Brazilian Industrial Production (YoY) |

-3.9% |

-5.8% |

-3.4% |

|

USD |

Redbook (MoM) |

0.70% |

0.50% |

|

|

USD |

New York NAPM |

551.80 |

543.10 |

|

|

USD |

Factory Orders (MoM) |

1.3% |

1.5% |

-1.1% |

|

USD |

Global Semiconductor Sales (MoM) |

-1.3% |

-2.7% |

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Economic Events scheduled for April 4, 2012 that affect the European and American Markets

TBD GBP Halifax House Price Index (MoM) -0.3% -0.5%

The Halifax House Price Index measures the change in the price of homes and properties financed by Halifax Bank Of Scotland (HBOS), one of the U.K.’s largest mortgage lenders. It is a leading indicator of health in the housing sector.

09:30 GBP Services PMI 53.5 53.8

The Services Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in the services sector. A reading above 50 indicates expansion in the sector; a reading below 50 indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

10:00 EUR Retail Sales (MoM) 0.1% 0.3%

Retail Sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity.

11:00 EUR German Factory Orders (MoM) 1.2% -2.7%

German Factory Orders measures the change in the total value of new purchase orders placed with manufacturers for both durable and non-durable goods. It is a leading indicator of production.

12:45 EUR Interest Rate Decision 1.00% 1.00%

The six members of the European Central Bank (ECB) Executive Board and the 16 governors of the euro area central banks vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

13:00 USD Treasury Secretary Geithner Speaks

Timothy Geithner (January 2009 – January 2013) is to speak. He speaks frequently on a broad range of subjects and his speeches are often used to signal policy shifts to the public and to foreign governments.

13:15 USD ADP Nonfarm Employment Change 200K 216K

The ADP National Employment Reportis a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile.

13:30 EUR ECB Press Conference

The European Central Bank (ECB) press conference is held monthly, about 45 minutes after the Minimum Bid Rate is announced. The conference is approximately an hour long and has two parts. Firstly, a prepared statement is read, then the conference is open to press questions. The press conference examines the factors which affected the ECB’s interest rate decision and deals with the overall economic outlook and inflation. Most importantly, it provides clues regarding future monetary policy. High levels of volatility can frequently be observed during the press conference as press questions lead to unscripted answers.

15:00 USD ISM Non-Manufacturing Index 57.0 57.3

The Institute of Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) (also known as the ISM Services PMI ) rates the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories. The data is compiled from a survey of approximately 400 purchasing managers in the non-manufacturing sector. On the index, a level above 50 indicates expansion; below indicates contraction.

Government Bond Auctions (this week)

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here