By FXEmpire.com

Gold Fundamental Analysis April 5, 2012, Forecast

Analysis and Recommendations:

REMEMBER, MOST GLOBAL MARKETS ARE CLOSED ON FRIDAY APRIL 6, 2012 AND MANY ARE CLOSED ON MONDAY APRIL 9, 2012 ALSO. VOLUME WILL BE LIGHT AND TRADERS WILL BE POSITIONING THEMSELVES FOR THE LONG HOLIDAY WEEKEND. ECONOMIC REPORTS WILL CONTINUE TO BE RELEASED ON FRIDAY, IN THE US THE NON FARMS PAYROLL REPORTS WILL BE ISSUED ON FRIDAY

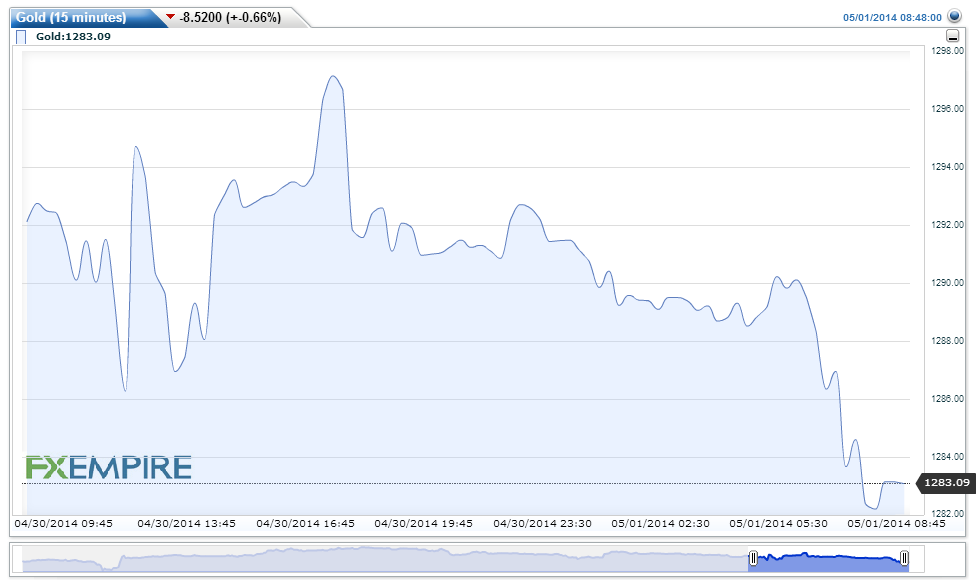

Gold has been falling since Tuesday afternoon joining a selloff in stocks and commodities after minutes from the U.S. Federal Reserve’s latest policy meeting undercut expectations for further monetary stimulus.

Gold slumped $52, or 3.1%, to $1,620..

“What we see today is a rather broad-based selloff in financial markets,” said Carsten Fritsch, an analyst at Commerzbank. “The trigger was yesterday’s Fed minutes which dashed hopes of (a third round of quantitative easing.)”

Minutes from the Federal Reserve Tuesday signaled that central-bank officials were less interested in another round of large-scale purchase of bonds.

The losses for precious metals came as European stocks slumped and U.S. equities opened sharply lower. The Dow Jones Industrial Average dropped 100 points in early trade.

This behavior “suggests gold is still mainly driven by speculative elements, not by long-term investors,” said Commerzbank’s Fritsch.

The impact of a higher U.S. dollar on the gold price will be particularly pronounced given that a large majority of gold is invested in the U.S.,” strategists at the National Australia Bank said. The National Australia Bank forecast gold to trade at around $1,620 an ounce over the June quarter.

Economic Events April 4, 2012 actual v. forecast

|

AUD |

Trade Balance |

-0.48B |

1.00B |

-0.97B |

|

GBP |

Halifax House Price Index (MoM) |

2.2% |

-0.3% |

-0.4% |

|

GBP |

Services PMI |

55.3 |

53.5 |

53.8 |

|

EUR |

Retail Sales (MoM) |

-0.1% |

0.1% |

1.1% |

|

EUR |

German Factory Orders (MoM) |

0.3% |

1.2% |

-1.8% |

|

PLN |

Polish Interest Rate Decision |

4.50% |

4.50% |

4.50% |

|

EUR |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

USD |

Treasury Secretary Geithner Speaks |

|||

|

RUB |

Russian CPI (MoM) |

0.6% |

0.5% |

0.4% |

|

USD |

ADP Nonfarm Employment Change |

209K |

200K |

230K |

|

EUR |

ECB Press Conference |

|||

|

USD |

ISM Non-Manufacturing Index |

56.0 |

57.0 |

57.3 |

Economic Events scheduled for April 5, 2012 that affect the European and American Markets

08:15 CHF CPI (MoM) 0.4% 0.3%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

08:30 EUR Dutch CPI (YoY) 2.50%

Consumer Price index is the most frequently used indicator of inflation and reflect changes in the cost of acquiring a fixed basket of goods and services by the average consumer. The weights are usually derived from household expenditure surveys.

09:30 GBP Industrial Production (MoM) 0.3% -0.4%

09:30 GBP Manufacturing Production (MoM) 0.1% 0.1%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. Manufacturing Production measures the change in the total inflation-adjusted value of output produced by manufacturers. Manufacturing accounts for approximately 80% of overall Industrial Production.

12:00 GBP Interest Rate Decision 0.50% 0.50%

12:00 GBP BOE QE Total 325B 325B

Bank of England (BOE) monetary policy committee members vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.The Bank of England electronically creates new money and uses it to purchase gilts from private investors such as pension funds and insurance companies. A higher than expected reading should be taken as negative/bearish for the GBP , while a lower than expected reading should be taken as positive/bullish for the GBP.

13:30 USD Initial Jobless Claims 355K 359K

13:30 USD Continuing Jobless Claims 3350K 3340K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week.

15:00 GBP NIESR GDP Estimate

The National Institute of Economic and Social Research (NIESR) gross domestic product (GDP) Estimate measures the change in the estimated value of all goods and services produced by the economy during the previous three months. The NIESR estimates GDP data on a monthly basis in an effort to predict the quarterly government-released data.

Government Bond Auctions (this week)

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Originally posted here