Economic Events

January 16

| All Day | USA | Holiday | United States – Martin Luther King, Jr. Day | |||||

| Tentative | CNY | Chinese GDP (YoY) | ||||||

Level 1 Level 2 Level 3

Resistance 1697.2 1664.1 1659.0

Support 1628.2 1609.3 1593.4

Gold Fundamental Analysis January 16 Forecast

Review and Analysis

Gold prices struggled to hold recent gains Friday as a successful Italian bond auction buoyed optimism about the direction of the Eurozone’s economy and dampened the safe-haven appeal of the yellow metal.

Ultra-cheap money from the European Central Bank has boosted the amount of cash Eurozone banks hold, and they did not hesitate Thursday to spend it on bonds from Spain and Italy that carry much higher interest rates than the money borrowed from the ECB.

Gold reached at a record $1,891.90 an ounce Aug. 22 as talk of additional quantitative easing from the Federal Reserve reached a fever pitch. But gold is down about 17% since then, closing Friday at $1,630.80 an ounce. Still, gold managed a 10% gain for 2011, much better than the Standard & Poor’s 500-stock index which finished the year flat on a price basis.

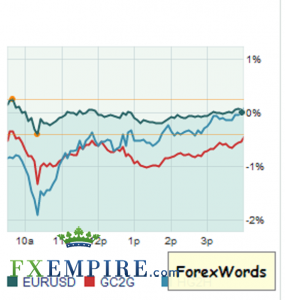

European headlines still impact gold futures, but increasingly the metal has traded on U.S. dollar moves.

The S&P downgrade of many of the european nations should have an immediate effect on the markets.

Gold futures closed 1% lower on Friday, weighed by a stronger dollar as investors left the euro on worries about a pending ratings cut for euro-zone countries. But prices ended the week 0.9% higher, helped in part by data showing Chinese demand was strong. Gold for February delivery ended down $16.90, or 1.03%, to an ounce on the Comex division of the New York Mercantile Exchange. The drop ended three straight days of gains, and Friday’s drop in gold partly related to profit taking, analysts said. Since the start of the year, gold has gained about 4%.

As investors continue to move to the USD on Monday and as Asian and European markets react to the downgrades, we should see some downward pressure on gold, but by the end of the day, we might see investors looking for additional safe-havens.

Originally posted here