By FX Empire.com

Gold Fundamental Analysis March 12, 2012, Forecast

Analysis and Recommendations:

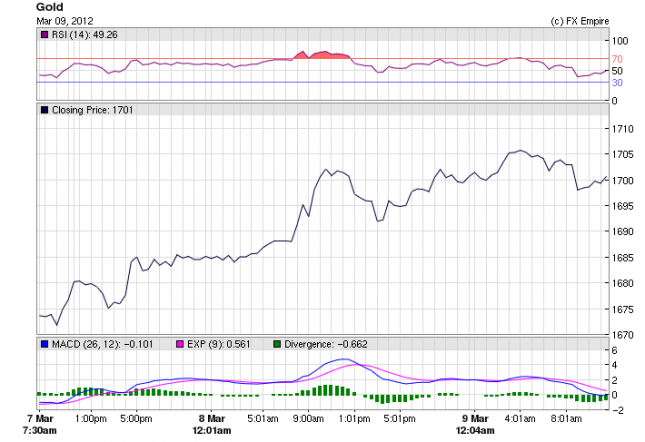

Gold moved back up the charts today, trading at 1713.05 up 14.35. As the US jobs reports were released Gold cascaded down falling as low as 1683.15 but then bounced right back up. Simultaneous with the jobs release was also the US trade balance which came in much higher than expected, giving the markets some negative news.

The U.S. trade deficit widened sharply in January, driven higher by record imports of autos, capital goods and food, government data reported. The trade gap expanded 4.3% in January to $52.6 billion from $50.4 billion in December.

The U.S. created 227,000 jobs in February and more people found work in the prior two months than previously reported, suggesting the economy’s recent momentum is likely to continue.

The unemployment rate, meanwhile, was unchanged at 8.3% as nearly half-a-million workers reentered the labor force in search of job, the Labor Department reported Friday. That’s usually a good sign because it means people believe more work is available.

The deal is done, finally. Greece finished their debt swap with private creditors. Bondholders representing some 85% of Greece’s outstanding private-sector debt, well above the government’s minimum threshold, have agreed to the swap, easing pressures on the eurozone.

Conditions are in place for Greece to get its second bailout, said Eurogroup President Jean-Claude Juncker in a statement released Friday. “I welcome the significant progress achieved in the preparation of the second Greek adjustment program,” said Juncker, after a teleconference between euro-zone finance ministers on Friday

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

Economic Releases actual v. forecast

|

Mar. 09 |

AUD |

Trade Balance |

-0.67B |

1.51B |

1.33B |

|

CNY |

Chinese CPI (YoY) |

3.2% |

3.6% |

4.5% |

|

|

CNY |

Chinese PPI (YoY) |

0.1% |

0.0% |

0.7% |

|

|

CNY |

Chinese Fixed Asset Investment (YoY) |

21.5% |

19.6% |

23.8% |

|

|

CNY |

Chinese Industrial Production (YoY) |

11.4% |

12.4% |

12.8% |

|

|

CNY |

Chinese Retail Sales (YoY) |

14.7% |

17.4% |

18.1% |

|

|

EUR |

German CPI (MoM) |

0.7% |

0.7% |

0.7% |

|

|

GBP |

Industrial Production (MoM) |

-0.4% |

0.4% |

0.4% |

|

|

GBP |

Manufacturing Production (MoM) |

0.1% |

0.4% |

1.1% |

|

|

GBP |

PPI Input (MoM) |

2.1% |

0.7% |

0.1% |

Upcoming Economic Events

06:45 EUR French CPI (MoM)

The French Consumer Price Index (CPI) measures the changes in the price of goods and services purchased by consumers.

08:15 CHF PPI (MoM)

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

09:30 GBP Current Account

The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the nation’s exports the data can have a sizable affect on the GBP.

19:00 USD Federal Budget Balance

The Federal Budget Balance measures the difference in value between the federal government’s income and expenditure during the reported month. A positive number indicates a budget surplus; a negative number indicates a deficit.

Government Bond Auction Schedule (this week)

Mar 12 10:30 Germany Eur 4.0bn new Sep 2012 Bubill

Mar 12 18:00 US Auctions 3Y Notes

Mar 13 09:30 Netherlands Eur 2.5bn-3.5bn re-opened Apr 2015 DSL

Mar 13 10:10 Italy BOT auction

Mar 13 10:30 Belgium Auctions 3 & 12M T-bills

Mar 13 15:30 UK Details gilt auction on Mar 22

Mar 13 18:00 US Auctions 10Y Notes

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here