By FX Empire.com

Gold Fundamental Analysis March 14, 2012, Forecast

Analysis and Recommendations:

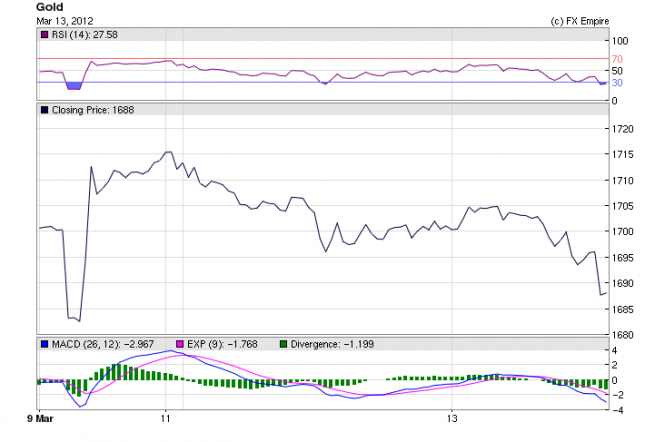

Gold dropped 3.35 to trade at 1696.45. The markets are gearing up for the Fed rate decision which will be “hold” along with the FOMC minutes, which is not expected to hold any surprises, but it is more likely to avoid mention of any QE, and as the markets hopes for additional monetary support, Gold should continue to fall. Tomorrow (Wednesday) Fed Chief Bernanke speaks and he has a way of making markets crazy. He might introduce “sterilization” or address the issue of QE or other policies. The markets are hoping to be able to interpret some direction from the minutes being released.

Economic Data March 13, 2012 actual v. forecast

|

JPY |

Tertiary Industry Activity Index (MoM) |

-1.7% |

0.4% |

1.8% |

|

GBP |

RICS House Price Balance |

-13% |

-14% |

-16% |

|

AUD |

Home Loans (MoM) |

-1.2% |

-0.1% |

2.1% |

|

AUD |

NAB Business Confidence |

1 |

4 |

|

|

JPY |

Interest Rate Decision |

0.10% |

0.10% |

0.10% |

|

EUR |

French CPI (MoM) |

0.4% |

0.4% |

-0.4% |

|

HUF |

Hungarian CPI (YoY) |

5.9% |

5.8% |

5.5% |

|

CHF |

PPI (MoM) |

0.8% |

0.3% |

0.0% |

|

SEK |

Swedish CPI (YoY) |

1.9% |

1.8% |

1.9% |

|

GBP |

Trade Balance |

-7.5B |

-7.8B |

-7.2B |

|

EUR |

German ZEW Economic Sentiment |

22.3 |

10.5 |

5.4 |

|

EUR |

ZEW Economic Sentiment |

11.0 |

3.8 |

-8.1 |

|

USD |

Core Retail Sales (MoM) |

0.9% |

0.8% |

1.1% |

|

USD |

Retail Sales (MoM) |

1.1% |

1.0% |

0.6% |

Economic Calendar March 14, 2012

10:30 GBP Average Earnings Index +Bonus 1.9% 2.0%

10:30 GBP Claimant Count Change 6.0K 6.9K

The Average Earnings Index measures change in the price businesses and the government pay for labor, including bonuses. Claimant Count Change measures the change in the number of unemployed people in the U.K. during the reported month. A rising trend indicates weakness in the labor market, which has a trickle-down effect on consumer spending and economic growth.

11:00 EUR CPI (YoY) 2.7% 2.7%

11:00 EUR Industrial Production (MoM) 0.7% -1.1%

11:00 EUR Core CPI (YoY) 1.6% 1.5%

This is a triple report covering all of the eurozone. The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

13:30 USD Current Account -114.0B -110.0B

The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the nation’s exports the data can have a sizable affect on the USD.

13:30 USD Import Price Index (MoM) 0.6% 0.3%

The Import Price Index measures the change in the price of imported goods and services purchased domestically.

15:00 USD Fed Chairman Bernanke Speaks

Federal Reserve Chairman Ben Bernanke (February 2006 – January 2014) is to speak. As head of the Fed, which controls short term interest rates, he has more influence over the U.S. dollar’s value than any other person. Traders closely watch his speeches as they are often used to drop hints regarding future monetary policy

Government Bond Auction Schedule (this week)

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Originally posted here