Gold Fundamental Analysis March 19, 2012, Forecast

Analysis and Recommendations:

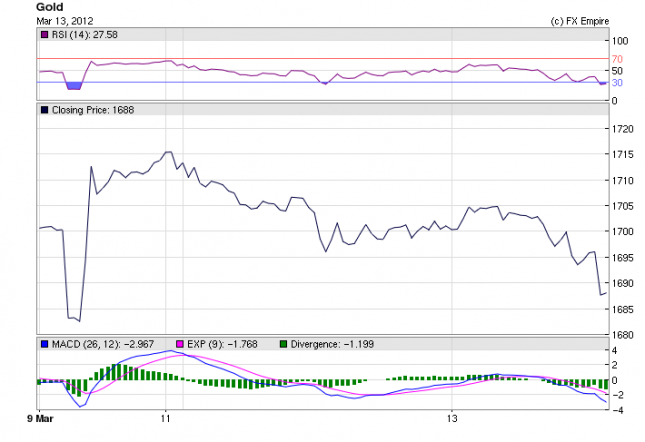

Gold fell to log a weekly loss of 3.3% as mostly upbeat economic data throughout the week lowed demand for the metal but concerns over inflation limited declines. Eventually investors will realize that gold can do well in both a deflationary environment as well as an inflationary environment, and the trend will turn significantly higher. Gold closed at $1,655.80 an ounce, down $3.70.

Minimal data was available in the US today.

U.S. economic data showed continued improvement, but with inflationary pressures starting to rise, [the Fed] may not be able to maintain its ultra-accommodative monetary policy for much longer. Today’s U.S. CPI data could prove to be the main catalyst for trade if it rises above the key 3% level on a year-over-year basis.

U.S. consumer prices increased 0.4% in February, owing mainly to the surging cost of gas, the Labor Department said Friday. The government also reported that inflation-adjusted hourly wages, on average, fell 0.3% in February as higher prices outstripped a 0.1% gain in earnings.

The output of the nation’s factories, mines and utilities was flat in February, the Federal Reserve said Friday. This was well below Wall Street expectations of a 0.4% gain.

Consumer sentiment in March declines for the first time since August, as rising gasoline prices cause a downturn in expectations, according to a key gauge released on Friday.

Released Economic Reports for March 16, 2012 actual v. forecast

|

EUR |

Italian Trade Balance |

-4.35B |

1.62B |

1.15B |

|

EUR |

Trade Balance |

5.9B |

6.2B |

7.4B |

|

USD |

Core CPI (MoM) |

0.1% |

0.2% |

0.2% |

|

USD |

CPI (MoM) |

0.4% |

0.4% |

0.2% |

|

Foreign Securities Purchases |

-4.19B |

6.27B |

7.38B |

|

|

CAD |

Manufacturing Sales (MoM) |

-0.90% |

0.60% |

0.60% |

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Economic Events for March 19, 2012

01:01 GBP Rightmove House Price Index (MoM)

The Rightmove House Price Index (HPI) measures the change in the asking price of homes for sale. This is the U.K.’s earliest report on house price inflation, but tends to have a mild impact because asking prices do not always reflect selling prices.

01:01 GBP Nationwide Consumer Confidence

Nationwide Consumer Confidence measures the level of consumer confidence in economic activity. It is a leading indicator as it can predict consumer spending, which plays a major role in overall economic activity. Higher readings point to higher consumer optimism.

13:30 CAD Wholesale Sales (MoM)

Wholesale Sales measures the change in the total value of sales at the wholesale level. It is a leading indicator of consumer spending.

Government Bond Auctions (this week)

Mar 19 n/a Greece CDS Auction

Mar 19 10:10 Slovakia Bond auction

Mar 19 10:10 Norway T-bill auction

Mar 20 09:30 Spain 12 & 18M T-bill auction

Mar 21 10:10 Sweden Nominal bond auction

Mar 21 10:30 Germany Eur 5.0bn Mar 2014 Schatz

Mar 21 10:30 Portugal Eur 0.75-1.0bn 4 & 6M T-bills

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Originally posted here