By FXEmpire.com

Gold Fundamental Analysis March 22, 2012, Forecast

Analysis and Recommendations:

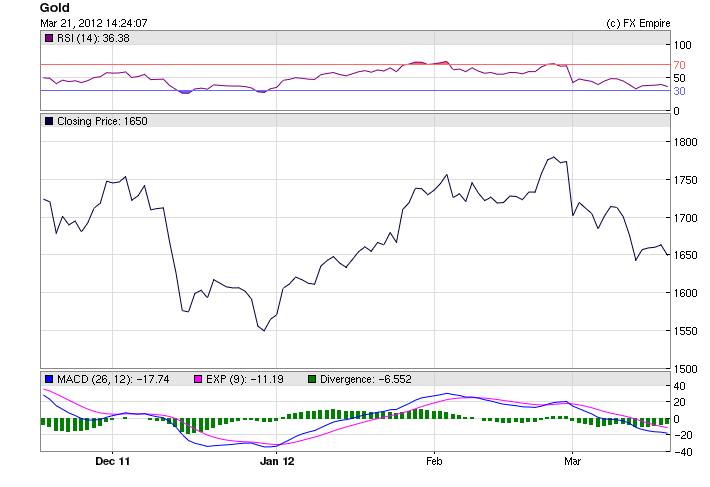

Gold made a modest advance today, regaining some of the ground lost from the prior day’s selloff as bargain hunters snapped it up at cheaper prices.

The yellow metal added $3.30, to close at $1,650.30 an ounce.

Gold is likely to remain range bound this week with nothing much to move it. With light volume, few market-moving headlines and reports on the horizon, and no “fear-trade out of Europe,” gold should remain flat.

It was a surprising day, usually when Fed Chairman Ben Bernanke speaks or testifies markets go crazy, he has a way of moving the Gold markets like a puppet master.

While the reduction in financial stress in Europe is a welcome development, more needs to be done to fully resolve the crisis, says top U.S. central banker Ben Bernanke. Treasury chief Tim Geithner’s also to deliver congressional testimony.

Economic Data March 21, 2012 actual v. forecast

|

Mar. 21 |

00:30 |

AUD |

MI Leading Index (MoM) |

0.6% |

0.7% |

|

03:00 |

NZD |

Credit Card Spending (YoY) |

4.0% |

3.1% |

|

|

05:30 |

JPY |

All Industries Activity Index (MoM) |

-1.0% |

-0.5% |

1.6% |

|

08:30 |

THB |

Thai Trade Balance |

0.52B |

-0.10B |

-0.20B |

|

08:30 |

THB |

Thai Interest Rate Decision |

3.00% |

3.00% |

3.00% |

|

10:30 |

GBP |

MPC Meeting Minutes |

|||

|

10:30 |

GBP |

Public Sector Net Borrowing |

12.9B |

5.2B |

-10.2B |

|

11:30 |

EUR |

German 2-Year Schatz Auction |

0.310% |

0.250% |

|

|

12:00 |

USD |

MBA Mortgage Applications |

-7.4% |

-2.4% |

|

|

13:30 |

Leading Indicators (MoM) |

0.6% |

0.6% |

0.4% |

|

|

14:30 |

USD |

Fed Chairman Bernanke Testifies |

|||

|

15:00 |

USD |

Existing Home Sales |

4.59M |

4.61M |

4.63M |

|

15:00 |

MXN |

Mexican Retail Sales (YoY) |

4.4% |

4.0% |

3.5% |

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Economic Events schedule for March 22, 2012

09:00 EUR French Manufacturing PMI

09:30 EUR German Manufacturing PMI

10:00 EUR Manufacturing PMI

The European, French, and German Manufacturing Purchasing Managers’ Index (PMI) measure the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

10:30 GBP Retail Sales (MoM)

Retail Sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity.

11:00 EUR Industrial New Orders (MoM)

Industrial New Orders measures the change in the total value of new purchase orders placed with manufacturers. It is a leading indicator of production.

13:30 USD Initial Jobless Claims

13:30 USD Continuing Jobless Claims

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance.

17:00 EUR ECB President Draghi Speaks

Mario Draghi (born 3 September1947) is an Italian banker and economist who has been governor of the Bank of Italy and succeeded Jean Claude Trichet as President of the European Central Bank starting November 2011. As head of the ECB, which controls short term interest rates, he has more influence over the EUR value than any other person. His comments may determine a short-term positive or negative trend.

Government Bond Auctions (this week)

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here