By FXEmpire.com

Gold Fundamental Analysis March 23, 2012, Forecast

Analysis and Recommendations:

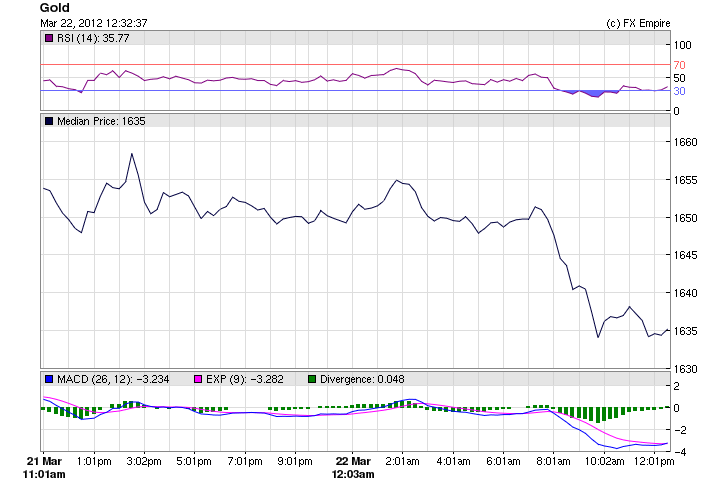

Gold continues to decline, trading at 1642.65 down from the open of 1650.15. Gold hit a low today of 1627.75 as investors moved back to the safety of the USD, gold began to fall. A strike by Jewelers in India over the governments doubling of the import duties again after just increasing it a short time ago, has upset manufacturers and buyers in India one of the major consumer of gold.

Gold has dropped almost 9% since late February when it traded at USD 1790.00 and is about 15% below the all-time high of USD 1,920 of September 2011.

The News the markets have been waiting for and hoping for. The number of Americans who filed requests for jobless benefits fell by 5,000 last week to 348,000, the lowest level since February 2008, the U.S. Labor Department said Thursday. Claims from two weeks ago were revised up to 353,000 from 351,000.

Applications for weekly unemployment benefits set a new four-year low, the government reports Thursday, in another sign that the U.S. labor market continues to gradually improve.

In the week ending March 17, the advance figure for seasonally adjusted initial claims was 348,000, a decrease of 5,000 from the previous week’s revised figure of 353,000. The 4-week moving average was 355,000, a decrease of 1,250 from the previous week’s revised average of 356,250.

Although worries about the slowdowns in China, also helped the fall of gold, behind India, China is the second largest importer of gold.

Economic Reports March 22, 2012 actual v. forecast

|

Date |

Currency |

Event |

Actual |

Forecast |

Previous |

|

Mar. 22 |

JPY |

Trade Balance |

-0.31T |

-0.34T |

-0.49T |

|

CHF |

Trade Balance |

2.68B |

1.90B |

1.50B |

|

|

EUR |

French Manufacturing PMI |

47.6 |

50.5 |

50.0 |

|

|

EUR |

French Services PMI |

50.0 |

50.6 |

50.0 |

|

|

EUR |

German Manufacturing PMI |

48.1 |

51.1 |

50.2 |

|

|

EUR |

German Services PMI |

51.8 |

53.1 |

52.8 |

|

|

EUR |

Manufacturing PMI |

47.7 |

49.6 |

49.0 |

|

|

EUR |

Services PMI |

48.7 |

49.3 |

48.8 |

|

|

EUR |

Spanish industrial New Orders (YoY) |

0.5% |

-2.0% |

-3.5% |

|

|

GBP |

Retail Sales (MoM) |

-0.8% |

-0.5% |

0.3% |

|

|

EUR |

Industrial New Orders (MoM) |

-2.3% |

-2.1% |

3.5% |

|

|

BRL |

Brazilian Unemployment Rate |

5.7% |

5.7% |

5.5% |

|

|

Core Retail Sales (MoM) |

-0.5% |

0.5% |

0.3% |

||

|

CAD |

Retail Sales (MoM) |

0.5% |

1.8% |

0.0% |

|

|

USD |

Initial Jobless Claims |

348K |

350K |

353K |

|

|

USD |

Continuing Jobless Claims |

3352K |

3390K |

3361K |

Economic Events for March 23, 2012

01:01 GBP Nationwide Consumer Confidence 49 47

Nationwide Consumer Confidence measures the level of consumer confidence in economic activity. It is a leading indicator as it can predict consumer spending, which plays a major role in overall economic activity. Higher readings point to higher consumer optimism

10:30 GBP BBA Mortgage Approvals 39.1K 38.1K

The British Bankers’ Association (BBA) Mortgage Approvals measures the number of new mortgages approved by BBA-backed banks during the previous month. It includes more than half of the total U.K. mortgage market. It provides information about the buyers in the housing market in the U.K.

12:00 CAD Core CPI (MoM) 0.3% 0.2%

12:00 CAD CPI (MoM) 0.5% 0.4%

CPI and Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

15:00 USD New Home Sales 325K 321K

New Home Sales measures the annualized number of new single-family homes that were sold during the previous month. This report tends to have more impact when it’s released ahead of Existing Home Sales because the reports are tightly correlated.

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Government Bond Auctions (this week)

Mar 23 10:10 Sweden

Mar 23 16:30 Italy Details CTZ/BTPei on Mar 27 & BOT on Mar 28

Mar 26 09:10 Norway Nok 3.0bn NST 474 3.75% May 2021 Bond

Mar 26 10:30 Germany Eur 3.0bn new Mar 2013 Bubill

Mar 26 15:30 Italy Details BTP/CCTeu auction on Mar 29

Mar 27 09:10 Italy CTZ/BTPei auction

Mar 27 08:30 Spain 3 & 6M T-bill auction

Mar 27 17:00 US Auctions 2Y Notes

Mar 28 09:10 Italy BOT auction

Mar 28 17:00 US Auctions 3Y Notes

Mar 29 09:10 Italy BTP/CCTeu auction

Mar 29 17:00 US Auctions 7Y Notes

Originally posted here