By FXEmpire.com

Gold Fundamental Analysis March 26, 2012, Forecast

Analysis and Recommendations:

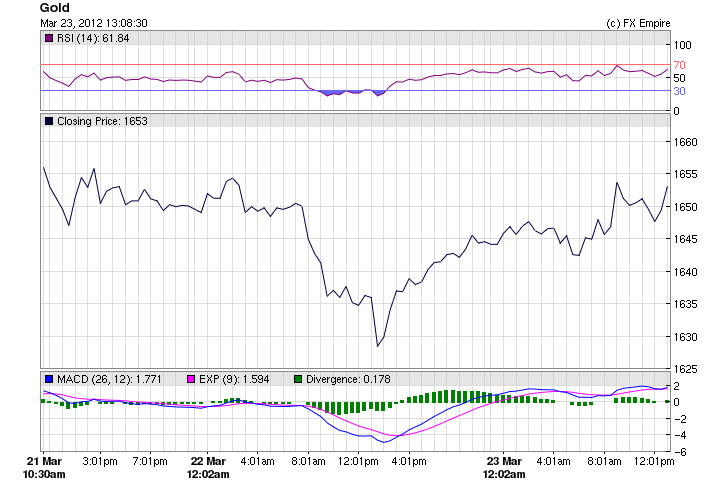

Gold futures climbed again today, reaching 1665.85 up +23.45 for the day, ending the week 0.4% for the week. Gold finished higher for the week as a decline in the U.S. dollar fed a broad rally in commodity markets. Looking ahead, analysts were a bit downbeat about the prospects for gold prices. Traders are expecting less liquidity injections (bond buying) by the federal government and as a realization of that permeates less active traders’ landscapes, we’ll see further declines in gold.

The improving economic outlook in 2012 may no longer warrant ultra-easy monetary conditions, according to a top Federal Reserve official on Friday, who said the central bank should step back from doing much more in terms of monetary stimulus.

Economic Reports March 23, 2012 actual v. forecast

|

Mar. 23 |

GBP |

Nationwide Consumer Confidence |

44 |

49 |

47 |

|

EUR |

French Business Survey |

96 |

93 |

93 |

|

|

EUR |

Spanish PPI (YoY) |

3.4% |

3.6% |

3.7% |

|

|

TWD |

Taiwanese Industrial Production (YoY) |

8.4% |

10.1% |

-16.8% |

|

|

EUR |

Italian Retail Sales (MoM) |

0.7% |

0.2% |

-0.8% |

|

|

GBP |

BBA Mortgage Approvals |

33.1K |

39.1K |

38.0K |

|

|

Core CPI (MoM) |

0.4% |

0.3% |

0.2% |

||

|

CAD |

CPI (MoM) |

0.4% |

0.5% |

0.4% |

|

|

BRL |

Brazilian Retail Sales (YoY) |

7.3% |

6.8% |

6.7% |

Economic Events Scheduled for March 26, 2012

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

07:00 EUR GfK German Consumer Climate

The Gfk German Consumer Climate Index measures the level of consumer confidence in economic activity. The data is compiled from a survey of about 2,000 consumers which asks respondents to rate the relative level of past and future economic conditions.

09:00 EUR German Ifo Business Climate Index

The German Ifo Business Climate Index rates the current German business climate and measures expectations for the next six months. It is a composite index based on a survey of manufacturers, builders, wholesalers and retailers. The index is compiled by the Ifo Institute for Economic Research.

15:00 USD Pending Home Sales (MoM)

The National Association of Realtors (NAR) Pending Home Sales Report measures the change in the number of homes under contract to be sold but still awaiting the closing transaction, excluding new construction.

Government Bond Auctions (this week)

Mar 26 09:10 Norway Nok 3.0bn NST 474 3.75% May 2021 Bond

Mar 26 10:30 Germany Eur 3.0bn new Mar 2013 Bubill

Mar 26 15:30 Italy Details BTP/CCTeu auction on Mar 29

Mar 27 09:10 Italy CTZ/BTPei auction

Mar 27 08:30 Spain 3 & 6M T-bill auction

Mar 27 17:00 US Auctions 2Y Notes

Mar 28 09:10 Italy BOT auction

Mar 28 17:00 US Auctions 3Y Notes

Mar 29 09:10 Italy BTP/CCTeu auction

Mar 29 17:00 US Auctions 7Y Notes

Originally posted here