By FXEmpire.com

Gold Fundamental Analysis March 28, 2012, Forecast

Analysis and Recommendations:

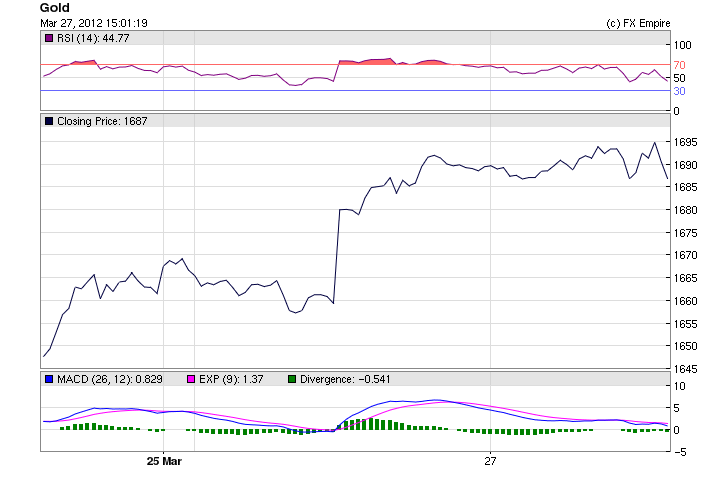

Gold peaked today at 1699.55, just short of the 1700.00 mark before declining to end the day at 1688.05. Gold dropped earlier to the low of 1683.55 as investors grabbed profits after a run on Monday after Fed Chairman Bernanke, said there was a possibility of further monetary easing, if required to boost the economy.

Gold soared over 26.00 during Monday’s session. Today, it pretty well held close to the upper end of its range.

Gold is expected to begin declining after the markets have fully digested Bernanke’s statements.

Economic Data for March 27, 2012 actual v. forecast

|

Mar. 27 |

JPY |

CSPI (YoY) |

-0.6% |

-0.4% |

-0.4% |

|

|

CHF |

Consumption Indicator |

0.87 |

0.93 |

|||

|

EUR |

German Import Price Index (MoM) |

1.0% |

1.0% |

1.3% |

||

|

EUR |

GfK German Consumer Climate |

5.9 |

6.2 |

6.0 |

||

|

EUR |

French Consumer Confidence |

87 |

83 |

82 |

||

|

EUR |

Netherlands GDP (YoY) |

-0.6% |

-0.7% |

-0.7% |

||

|

HKD |

Hong Kong Trade Balance |

-45.8B |

-15.0B |

-8.9B |

||

|

EUR |

Italian 2-Year CTZ Auction |

2.352% |

3.013% |

|||

|

GBP |

CBI Distributive Trades Survey |

0 |

-4 |

-2 |

||

|

TRY |

Turkish Interest Rate Decision |

5.75% |

5.75% |

5.75% |

||

|

HUF |

Hungarian Interest Rate Decision |

7.00% |

7.00% |

7.00% |

||

|

USD |

S&P/CS Home Price Indices Composite – 20 (YoY) |

-3.8% |

-3.8% |

-4.1% |

||

|

USD |

CB Consumer Confidence |

70.2 |

70.3 |

71.6 |

||

|

USD |

Richmond Manufacturing Index |

7 |

18 |

20 |

||

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Economic Events March 28, 2012 Europe and America

06:30 EUR French GDP (QoQ) 0.2% 0.2%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

09:30 GBP Business Investment (QoQ) -5.4% -5.6%

Business Investment measures the change in the total inflation-adjusted value of capital expenditure made by companies in the private sector.

09:30 GBP Current Account -8.4B -15.2B

The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the nation’s exports the data can have a sizable affect on the GBP.

09:30 GBP GDP (QoQ) -0.2% -0.2%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

T.B.D. EUR German CPI (MoM) 0.3% 0.7%

The German Consumer Price Index (CPI) measures the changes in the price of goods and services purchased by consumers.

13:30 USD Core Durable Goods Orders (MoM) 1.5% -3.0%

13:30 USD Durable Goods Orders (MoM) 3.0% -3.7%

Core Durable Goods Orders measures the change in the total value of new orders for long lasting manufactured goods, excluding transportation items. Because aircraft orders are very volatile, the core number gives a better gauge of ordering trends. A higher reading indicates increased manufacturing activity. Durable Goods Orders measures the change in the total value of new orders for long lasting manufactured goods, including transportation items.

Government Bond Auctions (this week)

Mar 28 09:10 Italy BOT auction

Mar 28 17:00 US Auctions 3Y Notes

Mar 29 09:10 Italy BTP/CCTeu auction

Mar 29 17:00 US Auctions 7Y Notes

Originally posted here