By FX Empire.com

Gold Fundamental Analysis March 7, 2012, Forecast

Analysis and Recommendations:

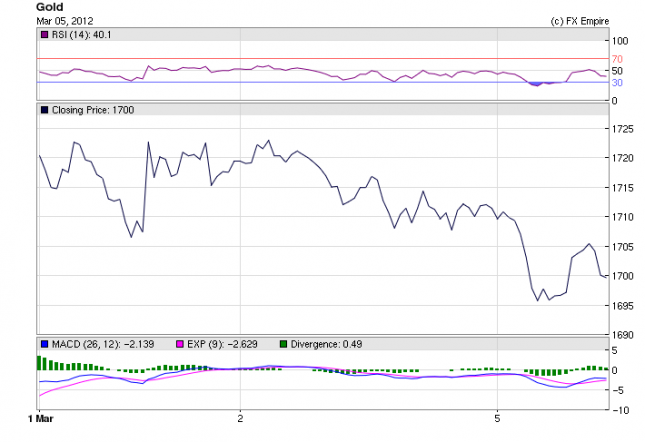

Gold had fallen off a cliff, down over 34.00 in today’s session currently trading at 1670.45. Gold fell to a low not seen since early January, as investors worried about the deadline approaching for the Greek PSI bond swap. Rumors were flying all day most proved false, but the market still collapsed. Investors were once again running to the USD for safety, moving from the precious metal to the greenback. Also worries about the overall economic climate in the eurozone began to unnerve traders, most was overshadowed for the past few weeks with Greece in the center ring. Gold had been too inflated after ballooning up so quickly. The euro continued to drop today against all of its trading partners.

The next two to three days will give a much clearer picture once the March 8th deadline has passed and the ECB rate decision and several days of jobs reports coming from the US.

Economic Events: (GMT)

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

March 6, 2012 Economic Releases actual v. forecast

|

AUD |

Current Account |

-8.4B |

-8.0B |

-5.8B |

|

AUD |

Interest Rate Decision |

4.25% |

4.25% |

4.25% |

|

GBP |

Halifax House Price Index (MoM) |

-0.5% |

0.3% |

0.6% |

|

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

| Ivey PMI |

66.5 |

62.1 |

64.1 |

Scheduled Economic Events for March 7, 2012 (GMT)

13:15 USD ADP Nonfarm Employment 205K 170K

13:30 USD Nonfarm Productivity (QoQ) 0.8% 0.7%

13:30 USD Unit Labor Costs (QoQ) 1.2% 1.2%

The ADP National Employment Report is a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile.

Nonfarm Productivity measures the annualized change in labor efficiency when producing goods and services, excluding the farming industry. Productivity and labor-related inflation are directly linked-a drop in a worker’s productivity is equivalent to a rise in their wage.

Unit Labor Costs measure the annualized change in the price businesses pay for labor, excluding the farming industry. It is a leading indicator of consumer inflation.

Sovereign Bond Auction Schedule

Mar 07 10:10 Sweden Nominal bond auction

Mar 07 10:30 Germany Eur 4.0bn Feb 2017 Bobl

Mar 07 10.30 UK Auctions new Sep 2017 conventional Gilt

Mar 08 16:00 US Announces auctions of 3Y Notes on Mar 12, 10Y Notes on Mar 13 & 30Y Bonds on Mar 14

Mar 08 16:30 Italy Details BOT auction on Mar 13

Mar 09 11:00 Belgium OLO mini bond auction

Mar 09 16:30 Italy Details BTP/CCTeu on Mar 14

Originally posted here