By FXEmpire.com

Gold Monthly Fundamental Forecast April 2012

Outlook and Recommendation

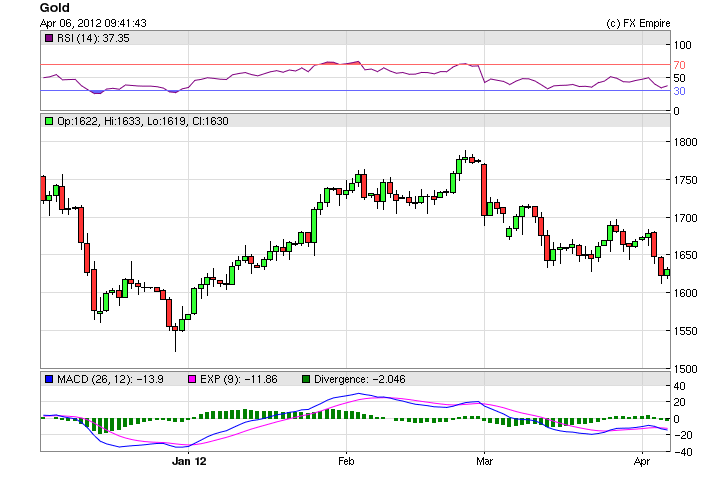

Gold ranged in the month of April, for a high of 1726.95 to a low of 1627.75 after tumbling at the end of the month after it was unable to break the 1700 resistance level. We can expect gold to continue to trade this month under the 1650 price.

After the record run in gold prices, followed by the subsequent sell-off, exchange traded funds that follow gold prices could be past their prime as one commodities market researcher argues gold has already peaked.

According to the CPM Group, gold prices will remain high but won’t jump above their record highs seen in 2011,.

“We reached the cyclical peak later than we thought but by the end of the year the price was down and (gold) has been trading sideways,” Jeff Christian, Founder and Managing Director of the CPM Group, said in the article.

In the company’s “Gold Yearbook 2012,” the report highlights the higher gold supply coupled with a set pool of demand will keep a floor under the market, with prices to remain firm. Consequently, gold prices could begin to consolidate over the next few years.

“We are looking for the price to stay above $1,500 this year and above $1,400 over the next few years,” Christian added.

Both USB and Bank of America have revised their gold forecast, reducing the demand.

FED INTEREST RATE DECISION

Cons.: Previous: 0.25%

The Board of Governors of the Federal Reserve announces an interest rate. This interest rate affects the whole range of interest rates set by commercial banks, building societies and other institutions for their own savers and borrowers. It also tends to affect the exchange rate. Generally speaking, if the Fed is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the USD.

Understanding Gold:

When fundamental and technical forces are in alignment, as with the current situation in gold, price action traders have an extremely valuable opportunity because trading with price action allows for much more accurate entries than other methods as well as providing traders with a “set and forget” style of trading when used in combination with simple risk to reward scenarios.

- Gold reacts to uncertainity in the markets

- A drop in major currencies can indicate a run into gold.

- Remember investors tend to take profit from gold so watch for trading opportunties when investors are taking profits, not moving out of the markets.

Historical

High: 1916.20

Low: 1321.10

Originally posted here