Now we can get back to what matters in the market and screen out the noise.

Yes, December gold futures (GCZ) settled more than $40 an ounce higher ounce on Thursday after U.S. lawmakers agreed a last-minute deal to increase the country’s debt ceiling, averting a technical default, and put the government back to work after a 16-day shutdown.

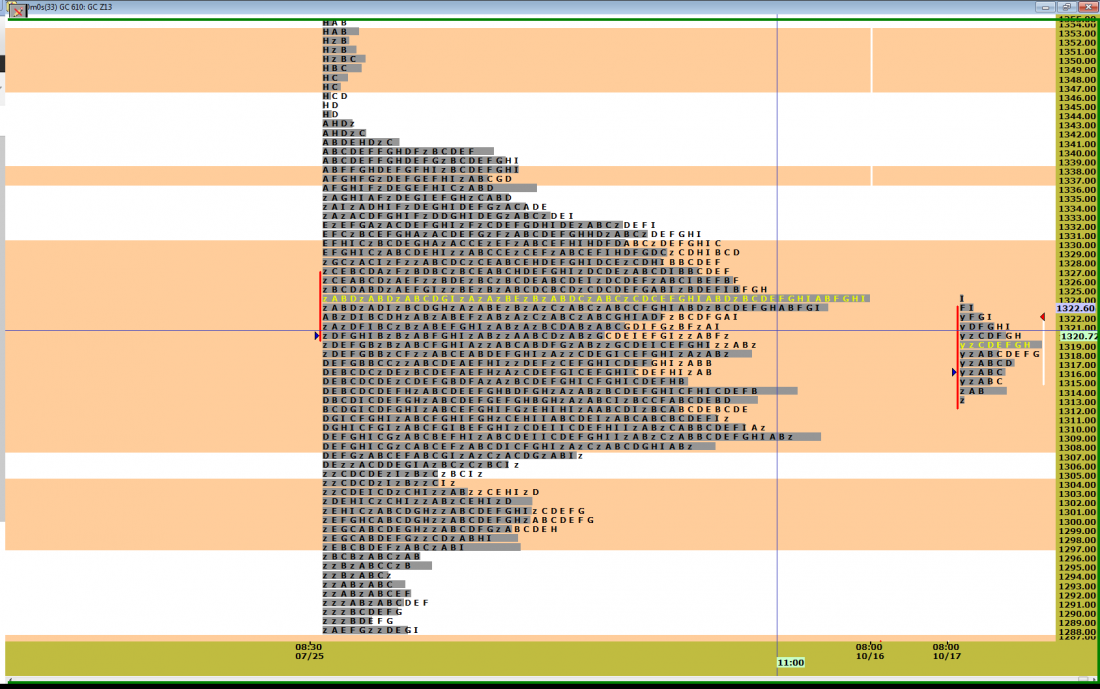

PRICE AND VOLUME

So now what? The only truisms in the market are price and volume and instead of listening to the discourse in Washington, we look at a Market Profile® chart. You can see that after the gap open higher on Thursday, GCZ remained in the middle of a concentrated distribution of previous price action (The High Volume Areas shaded area on the chart).

GCZ Trade Setups

The High Volume Areas (HVA) are powerful indicators that first attract and then repel price, acting as support/resistance and entry/exit targets. For a market contained inside of an HVA, we would look to trade the edges of participation. From the short side, the entry would be at 1330.40 with a downside target of 1307.50. The stop would be placed at least two points outside of the HVA in the area of price rejection. The same logic applies on the long side. The market should remain in this region of acceptance and if the market heads lower, you could enter at 1307.50 with an upside target of 1330.40. Again, your stop would be below the bottom of the HVA.

= = =

Click here to learn more about High Volume Area Trading at Trading Advantage.