Gold has been having a great 2014, unlike many other asset classes, with the shiny metal up nearly 15% year-to-date. In February I discussed gold breaking above resistance and showing a positive divergence in momentum. This helped give confidence in the run gold has had and taken it up to prepare for a test of $1,400/oz.

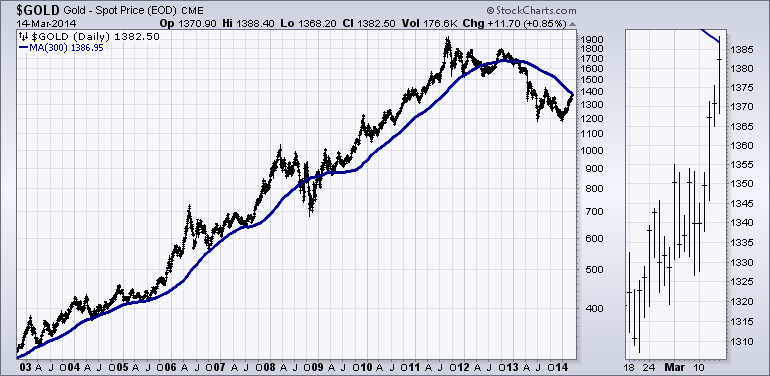

One moving average that doesn’t get mentioned very often for gold is the 300-day MA. This has acted as great support and resistance for gold and is something that’s being tested right now. As the 11-year chart below shows, during the bull market in gold, the 300-day MA acted as support during the majority of short-term corrections in price. In late-2012 we saw gold prices break through the long-term moving average and eventual 400 point drop.

KEY QUESTION

Will this moving average once again be important for traders and act as resistance or will we see price break through and continue on to $1,400? If we do break the 300-day MA I’ll be watching the August ’13 high of $1,435 as the next level of resistance. The August high will likely bring about a fair share of supply into the gold market and may require bulls to take a breath if they plan to continue the uptrend in price.

Finally, we also have a historically high reading in sentiment based on the Commitment of Traders (COT) data for gold. According to SentimenTrader’s Gold Sentiment Score, gold topped out at 92% in September 2012 and is now registering at 75%, which is just under the ‘overbought’ level of 80. SentimenTrader notes that, “over the past 20 years, there have only been four other times that sentiment climbed to 75% while gold was still at least 10% below its previous 52-week high. […] Each of those times, the rally was close to petering out, leading to negative returns over the next month (at least) each time, averaging -4.6%.”

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

RELATED READING

Read an article on using sentiment in your trading by Jason Goepfert