By FXEmpire.com

Gold Weekly Fundamental Analysis April 16-20, 2012, Forecast

Introduction: Gold prices always rise when there is uncertainty in the global economy. In times of uncertainty, wealthy investors tend to run towards gold. Suppose, rumors are flying high about some event in the world and this is increasing the uncertainty in the financial markets.

Gold reacts to uncertainty in the markets

A drop in major currencies can indicate a run into gold. Remember investors tend to take profit from gold so watch for trading opportunities when investors are taking profits, not moving out of the markets.

Analysis and Recommendations:

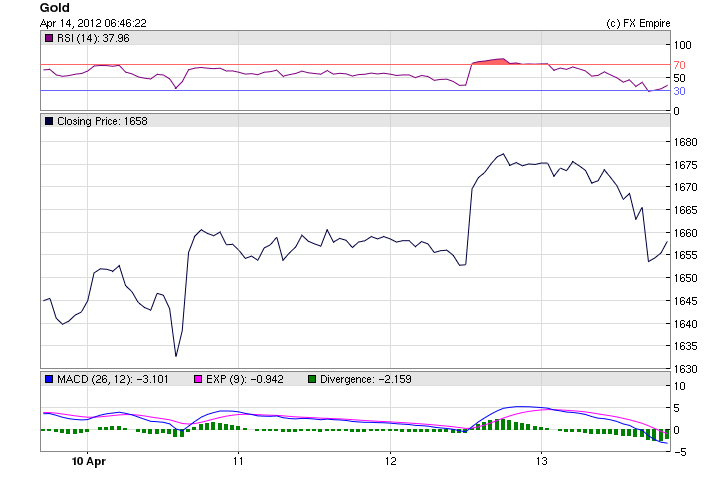

Gold bounced around this week, moving by investor’s worries, the Fed and Chinese data.

It has been a crazy week for gold bugs. Gold finally closed the week trading at 1659.25. During the week gold tested the 1700 price level unsuccessfully, trading as high as 1681.15 before falling late week trading to a low of 1633.50 at which time markets were looking at 1620 gold prices. Bank of America lowered their gold forecast for the 2012 to 1620.00

At the last minute on Friday as markets worried about disappointing data from the US and China gold began to fall but the biggest worry is Spain, regardless of how many times the Spanish Prime Minister denies that Spain will need a rescue the more markets are sure they will.

Borrowing costs for Spain and Italy skyrocketed toward the end of the week. Investors quickly moved back to USD.

|

Date |

Last |

Open |

High |

Low |

Change % |

|

04/13/2012 |

1659.25 |

1676.75 |

1679.15 |

1650.45 |

-1.04% |

|

04/12/2012 |

1676.55 |

1660.65 |

1681.15 |

1651.65 |

0.96% |

|

04/11/2012 |

1660.55 |

1658.25 |

1663.45 |

1654.15 |

0.14% |

|

04/10/2012 |

1658.35 |

1644.15 |

1663.95 |

1633.05 |

0.86% |

|

04/09/2012 |

1643.95 |

1643.85 |

1649.75 |

1636.85 |

0.01% |

Historical

High: 1916.20

Low: 1321.10

Major Economic Events for the past week actual v. forecast

|

Apr. 09 |

CNY |

Chinese CPI (YoY) |

3.6% |

3.3% |

3.2% |

|

Apr. 10 |

USD |

Fed Chairman Bernanke Speaks |

|||

|

JPY |

Interest Rate Decision |

0.10% |

0.10% |

0.10% |

|

|

JPY |

BoJ Press Conference |

||||

|

Apr. 12 |

Trade Balance |

0.3B |

2.0B |

2.0B |

|

|

USD |

Trade Balance |

-46.0B |

-52.0B |

-52.5B |

|

|

USD |

Initial Jobless Claims |

380K |

355K |

367K |

|

|

Apr. 13 |

CNY |

Chinese GDP (YoY) |

8.1% |

8.3% |

8.9% |

|

USD |

Core CPI (MoM) |

0.2% |

0.2% |

0.1% |

|

|

USD |

CPI (MoM) |

0.3% |

0.3% |

0.4% |

Economic Highlights of the coming week that affect the US Dollar

|

Apr. 16 |

13:30 |

USD |

Core Retail Sales (MoM) |

0.6% |

0.9% |

|

13:30 |

USD |

Retail Sales (MoM) |

0.4% |

1.1% |

|

|

13:30 |

USD |

NY Empire State Manufacturing Index |

21.1 |

20.2 |

|

|

14:00 |

USD |

TIC Net Long-Term Transactions |

101.0B |

||

|

Apr. 17 |

13:30 |

USD |

Building Permits |

0.71M |

0.71M |

|

13:30 |

USD |

Housing Starts |

0.70M |

0.70M |

|

|

14:15 |

USD |

Industrial Production (MoM) |

0.5% |

Originally posted here